Table of contents

Table of contents

With the rise of online donations and mobile payments, nonprofits are looking for ways to expand their payment options. 63% of donors prefer to give online with a credit or debit card, and Venmo is a leading platform in this trend.

Venmo offers a convenient, simple way to send and receive money using just a smartphone. With the right fundraising platform, supporters can now use Venmo to donate to the causes they care most about—like yours!

We'll go over everything you need to know about Venmo for nonprofits—including what it is, how it works, and what every nonprofit should consider before creating an account.

What is Venmo, and how does it work?

Venmo is a peer-to-peer (P2P) mobile payment service that lets users transfer money to other account holders.

How does it work?

💳 Link a payment method: Users connect their bank account, credit card, or debit card to the Venmo app.

💸 Send and receive payments: Venmo users can request, send, and receive money without exchanging cash or checks.

💰Withdraw funds: Users can

- Cash out immediately to their bank account (for a small processing fee)

- Transfer within 1–2 business days for free

- Keep funds in Venmo for quick payments, like splitting a bill or sending money for gifts

Purchased by PayPal in 2013, Venmo has broadened its scope in recent years, becoming more appealing for organizations with a PayPal business account to use as a payment processor for donations.

Can nonprofits use Venmo for donations?

For a long time, nonprofits faced challenges when trying to accept donations via Venmo. Here’s why:

- ⛔️ Not designed for fundraising: Venmo wasn’t built with nonprofits in mind, so creating an account and soliciting donations came with multiple restrictions and risks.

- ⚠️ Lack of donation campaign support: Verifying organizations was difficult, making it challenging to prevent fake profiles and unauthorized fundraisers.

So, what changed?

Givebutter was one of the first major fundraising platforms to integrate Venmo donations, making it seamless for supporters to contribute. With Givebutter, nonprofits can accept Venmo donations through:

✔️ Simple donate buttons

✔️ Custom-branded fundraising pages

✔️ Fundraising events

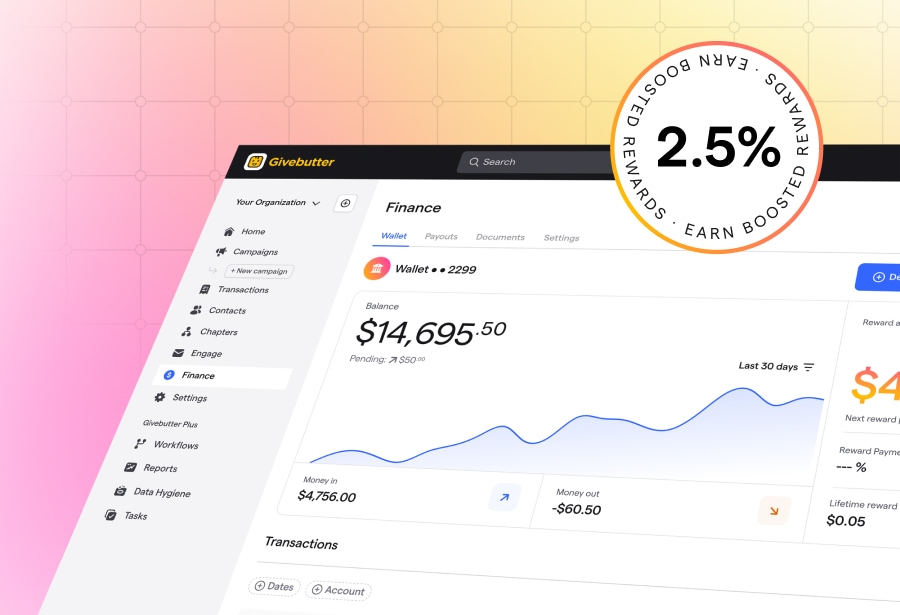

Venmo donations and donor contact information are automatically tracked in Givebutter’s built-in CRM so nonprofits can easily manage funds, track progress, and follow up with donors.

The best part?

Givebutter users don’t even need to have a Venmo account for nonprofits to receive donations—it’s that easy.

Plus, every donation on Givebutter is safe and secure thanks to the PCI-compliant payments partner, Stripe. For another layer of credibility, Givebutter adds a verification badge to a nonprofit's profile if its 501(c)(3) is verified by the IRS—giving donors the ultimate peace of mind that their contribution is going to the right place.

Is Venmo really that popular among donors?

Venmo launched publicly in 2011 and has seen exponential growth in recent years. In 2024, there were 68.3 million active Venmo users in the US, marking an 8.8% increase from 2023’s 62.8 million. This growth is expected to continue, with the largest annual rise anticipated between 2026 and 2027.

Research shows that the number of Venmo users has been rising year after year and is only expected to continue. The app’s popularity has even transformed its name into a verb, as in, “I’ll Venmo you for those fries right now.”

Is there such a thing as Venmo charity profiles or Venmo nonprofit accounts?

More fundraising platforms and business tools are now offering Venmo as a payment method for donors. Venmo's charity profiles give 501(c)(3) organizations enhanced visibility and a streamlined donation process. Any confirmed PayPal charity can set up a verified profile on Venmo, benefiting from features like:

- Blue checkmark badge

- Increased app visibility

- Lower transaction fees

Does Venmo charge a fee for nonprofits?

Currently, Venmo nonprofit fees are 1.9% + $0.10 per donation. So, if a supporter sends $100 via Venmo, your nonprofit organization will receive $98 of that donation.

While lower fees are always a welcome change, there are pros and cons nonprofits should consider before creating a charity profile or fundraising directly through Venmo.

Pros and cons of using Venmo for nonprofit fundraising

The bottom line 👇

Rather than setting up a Venmo account and charity profile directly on the Venmo app, most clubs, teams, and other organizations will be better off using a different fundraising platform that enables Venmo as one of several payment options for donors.

How to set up Venmo for nonprofits the right way

We’ve streamlined the process for donors to give via Venmo in just a few seconds on any Givebutter campaign—and you don’t even need a Venmo charity account.

Here’s how to set up Venmo for donations:

Step 1. Create a free account, and we’ll do the rest 🤩

All Givebutter campaigns automatically have a built-in Venmo payment option, so there’s no complicated setup. Simply create your free Givebutter account, enable Venmo, and you’re ready to go.

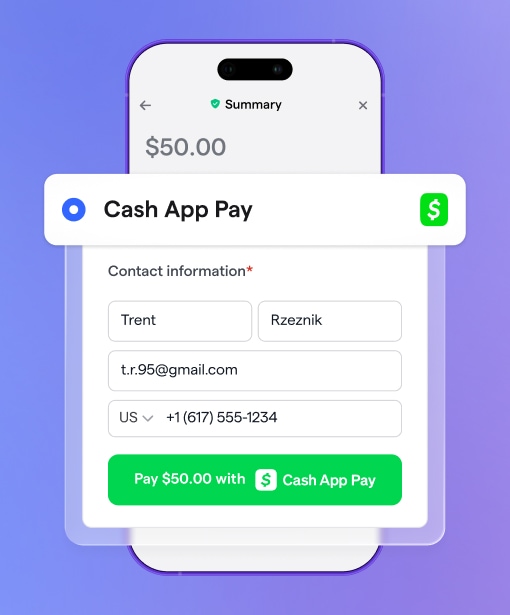

Your organization doesn't need a nonprofit Venmo account to receive donations. These will be treated like any other donation on Givebutter—including all major credit cards, Cash App, PayPal, Google Pay, Apple Pay, cash, checks, and ACH—and can be withdrawn directly from your dashboard along with the other funds you raise.

What real Givebutter users are saying:

Givebutter has been great for us. The platform is easy to navigate, I can set up as many different campaigns as I want, I can link campaigns into a fund that makes it easy to track, and donors can use payment systems like Venmo, which a lot of younger people prefer. — Givebutter review, Michael G.

Step 2. Launch your fundraiser and start accepting donations with Venmo 🎁

With Givebutter, you can collect donations, run fundraising campaigns, sell tickets to events, and manage everything through your Givebutter dashboard. Add a custom Venmo donate button to your website, and combine text-to-donate with Venmo for quick SMS and text-enabled giving.

You aren’t limited to one-off donations, either. While Venmo doesn’t support recurring giving, with Givebutter, you can enable recurring donations through several other payment methods on any of your campaigns, events, or donation pages. Donors can choose to give monthly, quarterly, or annually.

Step 3. Transfer your funds and let donors cover fees 🙌

You don’t need a Venmo nonprofit account to accept or transfer funds on Givebutter. All donations are pooled together with other types of payments for fast campaign payouts.

While charity profile users face additional Venmo nonprofit fees for instant payouts, verified nonprofits on Givebutter can set up automated nightly payouts for free.

With optional tips enabled, your nonprofit pays $0, backed by the Givebutter Guarantee, which covers any platform or processing fees donors don’t opt to cover. If you disable tips, a flat 3% platform fee applies, plus standard processing fees you can choose to pass on to donors, make optional, or cover yourself. By comparison, Venmo’s nonprofit fees don’t allow donors to cover transaction costs for charity profiles, meaning you never receive 100% of your donations.

Step 4: Thank donors and track your fundraising progress 💛

Givebutter sends automatic tax receipts to Venmo donors, and with the ability to customize your thank you messages, you'll save time and build stronger relationships with your supporters.

All of your donation data and donor contact information is automatically saved in Givebutter’s built-in nonprofit CRM. You can also connect your account with top-notch CRMs using Givebutter integrations. Either way, you can say goodbye to hours of manual data entry.

Venmo limits you should be aware of

Personal payment limits

Verified Venmo users have a rolling weekly spending limit of $7K for payments to authorized businesses and charities (reduced to $299.99 per week for unverified accounts).

Even if your donors aren’t making gifts this large, they could still hit this limit as their weekly spending adds up, as it includes payments sent to other Venmo users, too.

🧈 How Givebutter helps: Givebutter offers your donors multiple payment methods so they don’t run into roadblocks like the one mentioned above.

Fortunately, with Givebutter, you can accept all major credit cards, PayPal, Google Pay, Apple Pay, cash, and checks—so if a donor encounters Venmo’s limits, there are plenty of other options available.

Bank transfer limits

Venmo also imposes a weekly rolling limit on bank transfers for charity profiles. The current limit is $10K for transfers to debit cards and $50K for instant transfers to your bank account. No organization wants to lose out on funding because donors are sending too much money.

🧈 How Givebutter helps: We understand how important it is for you to access funds quickly and securely. That’s why we don't set any limits on when or how often you can withdraw—unlike Venmo’s charity profiles.

Venmo for charities and nonprofits: Best practices

Adding Venmo to your fundraising toolkit opens the door for your donors to give in a quick and easy way. Venmo captures the attention of younger donors and streamlines the donation process for everyone.

While adding Venmo as a donation method is a great start, you can get the most out of this option with the following tips:

- Promote using Venmo to donate 📣 Let your donors know they can now give via Venmo for an even faster way to support your cause. Promote this new option across your marketing campaigns, fundraising pages, and social media.

- Pair with other mobile giving choices 📱If you’re adding Venmo as an option to your donation forms, why not consider other mobile giving methods, too? Givebutter offers free access to not only Venmo but also PayPal, text-to-donate, and Tap to Pay.

- Use Venmo alongside Givebutter for even more benefits ✨ You can set up a charity account with Venmo yourself, or you can sign up for Givebutter to enjoy not only this user-friendly donation method but also all the fundraising features you could ever need—and all for free!

- Leverage Venmo groups for collective giving 🤝 Venmo groups allow supporters to pool their donations toward a shared goal, making it easier to fundraise as a team. Encourage donors to create groups dedicated to your cause and inspire peer-to-peer giving.

Get the best of both worlds with Givebutter and Venmo

Venmo has revolutionized the way we send and receive money, creating new fundraising opportunities for organizations. As a payment method, it’s easy to use, popular with younger donors, and generates positive word-of-mouth through its social media-style feed.

As an online donation tool, Venmo shines brightest when paired with a fundraising platform that supports it. By adding Venmo as a payment option, you can offer donors multiple ways to give from one central hub while still retaining essential features like recurring gifts, tax receipts, and other integrations.

Accept Venmo donations without the hassle

Ready to think beyond credit cards, expand your donor base, and raise more for your mission? Sign up for your free Givebutter account today.

FAQs: Top questions about Venmo for nonprofits

Can nonprofits use Venmo to accept donations?

Yes, Venmo offers a charity profile option, which allows verified 501(c)(3) organizations to collect donations. You’ll need to integrate Venmo with your fundraising platform to accept donations.

How can nonprofits integrate Venmo into their payment processing stack?

Nonprofits can integrate Venmo by using fundraising apps that support it. Without this integration, you won’t be able to collect donations via Venmo. Givebutter users can easily accept Venmo donations, as it’s automatically integrated into the platform.

What are the benefits of using Venmo for nonprofits?

Venmo can improve your payment processing in several ways:

- User-friendly mobile experience: Meets donor expectations for convenient mobile giving

- Instant donations: Supporters can donate quickly and easily

- QR code fundraising: Collect cashless donations at events, allowing supporters to give on the spot

- Fast access to funds: Withdraw and access funds quickly, even while on the go

What are the limitations of using Venmo for nonprofits?

Venmo has some limitations for nonprofits:

- Transaction limits: Restrictions on user transactions and charity bank transfers

- No recurring donations: Does not support automatic monthly giving

- Manual donor data entry: Charity profiles don’t sync with donor management systems, requiring manual CRM updates

- Lack of recurring giving options: Harder to establish a reliable base of monthly donors

Do you have to link a bank account to a Venmo account used for fundraising?

Yes—linking a bank account is necessary to withdraw funds directly from Venmo.

Can I create a second Venmo account for a nonprofit or sports team fundraiser?

Venmo does not allow multiple accounts tied to the same number, which can be a barrier for volunteers managing multiple teams or club funds.

Will using my personal Venmo for team fundraising create tax issues?

It’s important to keep nonprofit finances separate from individual accounts. Whenever possible, use a business or charity profile.

Are there better alternatives to Venmo for youth sports or small nonprofit fundraising?

Givebutter is a free and easy alternative to Venmo for youth sports, small nonprofit fundraising, and more. Teams can create unlimited donation forms, fundraising pages, and peer-to-peer campaigns, all of which easily accept Venmo donations—teams don’t even need to have a Venmo account!

Can Venmo be used without a ‘real’ mobile number?

A surprising roadblock: Venmo won’t accept virtual numbers like Google Voice. This can be an issue for small teams looking to set up temporary or shared fundraising accounts.

Is Venmo really a good fit for nonprofit fundraising?

While Venmo is a convenient way for donors to give on the go, nonprofits are better off using a fundraising platform that accepts Venmo payments, keeping all of your donations, donor information, and communication in one place.

.svg)

%20(1).png)

.svg)

_4x.webp)