Table of contents

Table of contents

Venture philanthropy blends the heart of giving with the playbook of venture capital. Instead of offering one-time grants, foundations, companies, and donor networks provide nonprofits with long-term funding paired with hands-on support like mentorship, strategic guidance, and access to broader networks.

When the fit is right, this approach can help organizations grow faster, strengthen internal systems, and focus on long-term impact. That said, venture philanthropy isn’t designed for every nonprofit. Opportunities can be competitive, and partnerships often come with specific expectations around growth, reporting, and performance.

In this guide, we’ll explain how venture philanthropy works in practice, what funders typically look for, pros and cons to consider, and how nonprofits can apply venture-style best practices even if they decide venture philanthropy isn’t the right path.

Key takeaways

- Venture philanthropy fuels social impact 🤝 Venture philanthropy combines funding with active support to drive measurable social outcomes.

- It’s geared toward long-term growth 🌲 Funders typically offer multi-year support, while organizations set clear goals to scale impact and strengthen capacity.

- Support goes beyond funding 💛 Venture philanthropy often pairs capital with mentorship, strategic and operational guidance, and access to valuable networks.

- Opportunities can be selective 🪣 Venture philanthropists focus on organizations that align with their mission and show strong potential to scale impact.

- Impact reporting is expected 📊 Organizations can expect to share regular data and progress updates tied to agreed-upon outcomes.

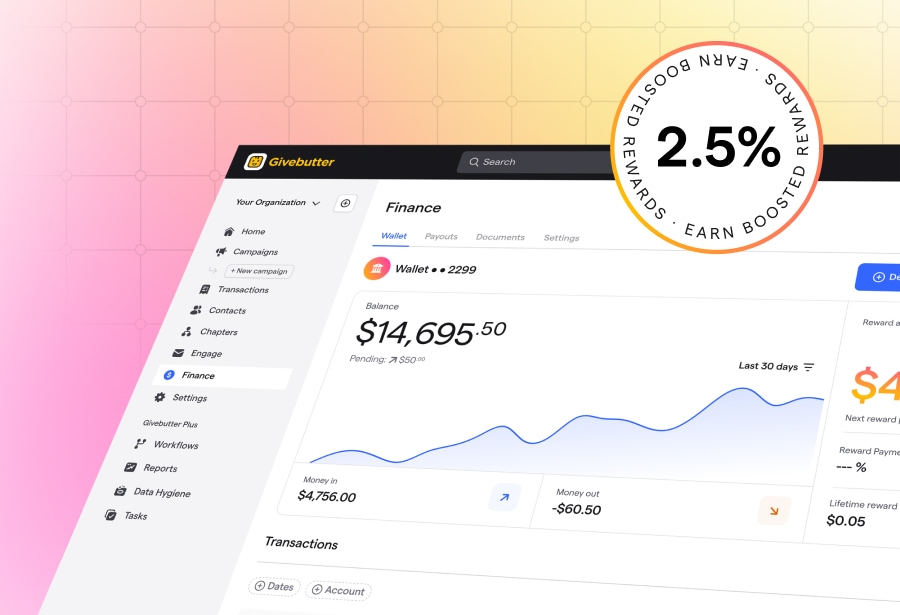

- Strong data helps you prepare 🧠 Using a platform like Givebutter to centralize donor, fundraising, and impact data makes it easier to demonstrate readiness to venture philanthropy funders.

What is venture philanthropy?

Venture philanthropy is a funding approach in which companies, foundations, donor networks, or individual funders provide nonprofits with both financial support and hands-on involvement, such as marketing, advising, or governance guidance. Unlike venture capitalists, venture philanthropists do not primarily seek a financial return. Instead, they focus on measurable social impact, expecting organizations to set clear development or impact goals.

Venture philanthropists often include foundations, high-net-worth individuals, donor networks, and collaborative funds that apply venture-capital-style principles to support social change. While this approach can offer significant benefits, it’s just one of many funding models nonprofits can use to support their mission.

The history of venture philanthropy 📈

Philanthropists like John D. Rockefeller III and Andrew Carnegie helped popularize the idea of applying business principles to philanthropy in the United States during the late 19th and early 20th centuries. Venture philanthropy models gained broader traction in the 1990s, as Silicon Valley-aligned donors and funds began applying venture-style practices to charitable and social causes.

Today, venture philanthropy organizations include foundations, LLCs, donor networks, and pooled funding groups of all sizes. Their common goal is to support social change through philanthropic investments that emphasize measurable outcomes, rather than traditional, hands-off grantmaking.

How does venture philanthropy work?

Venture philanthropists provide funding and hands-on resources to support measurable social impact. To focus their efforts, they typically concentrate on specific missions, stages, or organizational models rather than funding every type of nonprofit organization equally.

Below, we’ll break down what venture philanthropy partners typically look for and what they expect in return, so you can determine whether this approach makes sense for your nonprofit.

What venture philanthropists typically fund 👛

Venture philanthropists support nonprofits, social enterprises, and other mission-driven organizations. While priorities vary by funder, they often look for organizations that demonstrate the following:

- Outcomes-based 📈 Clear goals tied to specific, measurable social returns.

- Under-resourced or system-focused 🫶 Many funders prioritize communities that have historically been under-resourced or initiatives aimed at broader systems change.

- Growth potential 🌱 Venture philanthropy often supports early-stage organizations with the potential to scale in impact or organizational capacity over time.

- Collaborative leadership 👐 Beyond strong governance, funders look for leaders who value long-term partnership, learning, and shared accountability.

💡 Pro tip: If you decide to apply for venture philanthropy funding, be prepared to share precise data on your current progress, along with a long-term growth and sustainability plan. Givebutter’s donation management tools track results in real time with reporting, performance data, and donor insights.

What nonprofits are usually expected to provide in return 🤝

Venture philanthropy partners typically expect organizations to share regular impact data and progress updates tied to agreed-upon goals.

Common expectations may include:

- Number of beneficiaries helped

- Improved or more efficient systems

- Measurable impact tied to a specific social goal

🤔 Did you know? While many traditional grants last one to three years and require minimal engagement, venture philanthropy often involves multi-year, high-engagement support. For smaller teams, maintaining consistent reporting and growth over time can be challenging, which is an important consideration before pursuing this model.

Pros & cons of venture philanthropy

For some nonprofits, venture philanthropy can accelerate growth by pairing funding with active involvement. For others, the level of commitment, reporting, and alignment required can feel demanding.

Like any funding model, venture philanthropy comes with tradeoffs. It tends to work best as one part of a broader funding strategy, not a one-size-fits-all solution.

Benefits of venture philanthropy

✅ Brings new resources: Beyond funding, venture philanthropists often provide mentorship, strategic guidance, operational support, and access to leadership or board networks.

✅ Supports long-term solutions: Multi-year commitments can provide greater stability for planning, capacity building, and sustained impact.

✅ Expands your nonprofit network: Venture-style funders can connect nonprofits with new partners, advisors, and supporters beyond their existing donor base.

✅ Strengthens impact potential: With aligned goals and ongoing support, venture philanthropy can help organizations build the systems and capacity needed to drive meaningful, long-term change.

Venture philanthropy drawbacks

❌ Opportunities are selective: Venture philanthropists tend to fund only a small number of organizations that closely align with their mission and strategy, making this model less accessible for many nonprofits.

❌ Funding is comparatively modest: Despite the “venture” label, funding amounts are typically much smaller than venture capital rounds and should not replace diversified fundraising.

❌ High engagement can be demanding: The reporting, milestone tracking, and growth expectations associated with venture philanthropy can be challenging to sustain, especially for small or understaffed teams.

❌ Potential for mission pressure: Deep funder involvement can sometimes influence priorities or strategy. While this risk isn’t unique to venture philanthropy, it’s an important consideration when evaluating fit and alignment.

💡 Pro tip: If you want to partner with corporations but aren’t ready for the long-term expectations of venture philanthropy, a matching gift program can be a lower-commitment way to increase donations through corporate support.

Venture philanthropy examples

If you’re curious about what this funding approach looks like in practice, the examples below highlight how different organizations support social impact through venture philanthropy.

- The Cystic Fibrosis Foundation (CFF) 🧑⚕️ CFF is a landmark example of venture philanthropy, using a venture-style approach to fund research and drug development aimed at accelerating treatments and finding a cure for cystic fibrosis.

- Skoll Foundation 💛 Since 1999, the Skoll Foundation has invested more than $1.2B in social innovators working to address global challenges and advance equity through long-term, outcomes-focused support.

- New Profit 🌎 New Profit applies venture philanthropy principles to support more than 250 organizations focused on systems-level change in areas like democracy, education, and economic mobility.

Apply venture philanthropy best practices with Givebutter

For nonprofits with the capacity to build deeper partnerships, venture philanthropy can offer meaningful benefits, including multi-year support, strategic guidance, and access to new networks. If this model feels like a strong fit, start by researching funders whose priorities align with your mission and clarifying the goals and impact you want to demonstrate.

At the same time, venture philanthropy represents just one path forward. Whether or not you pursue it, nonprofits can still adopt venture-inspired best practices by tracking impact, staying transparent, and investing in long-term donor relationships. Givebutter makes this easier by helping you collect and organize fundraising data, donor insights, and engagement metrics that support these practices.

If venture philanthropy isn’t the right fit, Givebutter’s fundraising, CRM, events, and recurring donation tools can help you build sustainable funding on your own terms.

Strengthen donor relationships with a free CRM

Sign up for Givebutter today and build a stronger, more sustainable fundraising foundation.

FAQs about venture philanthropy

What’s the difference between venture philanthropy vs. traditional philanthropy?

Venture philanthropy applies venture-capital-style strategies to support social impact rather than businesses. Venture philanthropists typically provide funding, mentorship, and other resources over a period of years.

Traditional philanthropy usually centers on grants and often includes impact reporting and defined goals, but with less ongoing involvement from funders.

What’s the difference between venture philanthropy vs. impact investing?

In impact investing, firms invest capital in organizations to generate both social impact and financial returns.

Venture philanthropy, by contrast, prioritizes social impact over financial return. Funding is often provided through grants or other flexible capital, with the primary return being measurable social change supported by high-performance partnerships.

How competitive is venture philanthropy funding?

Venture philanthropy is highly competitive. Funders typically support a small portfolio of organizations with a clear growth or impact strategy and strong alignment with their mission or focus areas.

For the best chance of success, follow venture philanthropy news and tap your network to identify mission-aligned opportunities. Then prepare your pitch with data that demonstrates your organization’s direction, track record of results, and potential to scale impact. It’s also important to remember that this is just one funding option among many.

What types of nonprofits are a good fit for venture philanthropy?

Funders typically look for nonprofits with clear plans to grow impact or strengthen organizational capacity, as well as the ability to sustain long-term, high-engagement partnerships. Strong operations, transparency, and openness to collaboration are key.

To be successful, organizations should have systems in place for tracking progress, a leadership team prepared for deeper involvement, and the capacity to commit time and resources to shared goals and reporting.

.svg)

%20(1).png)

.svg)

_4x.webp)

.webp)