Table of contents

Table of contents

You wrote down your mission and values, recruited a passionate group of volunteers, and named your newly-formed nonprofit. Now, you're ready to launch your nonprofit and transform your community, right?

Almost!

Before you can launch, you need to file for tax-exempt status with the IRS. Not only will this help preserve your budget as a scrappy nonprofit, but it can help increase your donations over time. Only donations made to registered 501(c) charitable organizations are tax-deductible, a major selling point when attracting new supporters.

Before you file for your tax-exempt status, you will need to understand the 501(c)(3) requirements under the Internal Revenue Code. It’s in your best interest to partner with a barred attorney or account who is well-versed in tax law when filing the paperwork. With that being said, below we offer an overview on 501(c)(3) requirements, and how to get started in filing for your tax exempt status.

Please note: This post is meant for informational purposes only, and should not be taken as legal advice.

What is a 501(c)(3) organization?

A 501c3 organization, or 501(c)(3) organization, is a nonprofit organization that filed for tax-exempt status with the IRS (Internal Revenue Service). There are a number of different types of nonprofits that can file as a 501(c)(3) organization, including:

- Religious, charitable, scientific, literary, or educational organizations

- Public safety organizations

- Private foundations

- Amateur sports competitions and organizations

- Organizations dedicated to preventing cruelty to animals or children

Organizations who file for their 501c3 status must be created to serve the greater good—in other words, they cannot serve the private interests of one small group or individual. For example, an organization that seeks to pass on donations to a political candidate cannot file for a 501(c)(3) status, because that type of organization would serve the exclusive interests of that particular candidate.

The primary benefit of filing for a 501(c)(3) status is to stay exempt from federal taxes.

However, this doesn't mean that these organizations are exempt from paying all taxes. According to IRS.gov, While registered 501(c)(3) are typically exempt from state and federal income tax, property taxes, and even sales tax, they will still have to pay employee taxes for all full-time staff.

501c3 requirements: how to file for 501c3 tax-exempt status

The application process to file as a 501(c)(3) organization can be a daunting process. Consider searching for an attorney to help guide you in filling out the required IRS forms. (Pro tip: Many state bar associations have a pro bono requirement for all barred attorneys—New York, as an example, sets this standard at a minimum of 50 hours. Therefore helping a startup nonprofit could be a win-win situation, offering you free legal advice while helping the attorney reach their pro bono quota.)

1. Determine your eligibility 📝

Before you start the application process, you need to ensure your type of nonprofit is actually eligible for 501(c)(3) status.

The Internal Revenue Code has 29 different sections of 501(c) organizations (Ballotpedia offers an excellent run-down of each, or you can look at an abbreviated list of tax-exempt organizations on the IRS.gov). Once you’re certain you fall under the list of 501(c)(3) organizations, you can go about filing your forms.

2. Determine whether you should file Form 1023 or Form 1023-EZ 📚

There are two different forms 501(c)(3) organizations can file for federal tax exemption: Form 1023 or Form 1023-EZ. Some organizations, primarily religious groups, are not required to fill-out either form.

As a grassroots startup, chances are you will need to fill out Form 1023-EZ, which is specifically created for smaller organizations. To be eligible, you must have assets less than $250,000, or annual gross receipts of $50,000 or less. If you anticipate receiving higher donations, you will fill out Form 1023. For more information, see page 4 of Publication 557 on IRS.gov.

Whichever form you choose to fill out, you must be able to prove three things:

- Your organization is built and operated exclusively for religious, charitable, scientific, literary, or educational purposes.

- Your organization won't try to influence legislation or political campaigns (there are a few exceptions, designed for certain lobbying activities).

- Your organization's earnings will not benefit any private shareholder.

3. Develop your articles of organization 💼

To register as a 501(c)(3) organization, you must create a legal entity that's separate from your founders, organizations, board of directors, or other staff.

If you are filling out Form 1023, this requires you to submit articles of organization with your application (those who fill out Form 1023-EZ can skip this step). Depending on your type of organizations, this may require you to create:

- A public charter (created under articles of incorporation)

- A trust instrument

- Articles of association

This document outlines your organization's name, mission, and bylaws, while limiting the personal liability of your board members or founders. Once created, your articles of organization will need to be approved by your secretary of state. (Pro tip: Harbor Compliance offers a free downloadable template to write your articles of incorporation.)

4. Get your finances in order 💰

To file for tax-exempt status under section 501(c)(3), every public charity must receive their own EIN (employer identification) number. To do this, your nonprofit will need to fill out Form SS-4, Application for Employer Identification Number. Form SS-4 requires basic information, including your contact information, type of entity, and reason for applying.

All 501(c)(3) organizations have certain reporting requirements in order to keep their tax-exempt status. Therefore, once you have your EIN number, you should create a bank account specifically for your organization. This will help keep track of any and all fundraising campaign activities, unrelated business income, and tax-deductible expenses.

At the end of each year, you'll use your record books to fill out an annual information return (the nonprofit equivalent of a tax return). Typically, you'll have to fill out either Form 990, Form 990-EZ, or Form 990-N, depending on your type of organization.

Partner with an expert to fill out your 501(c)(3) requirements

Hopefully, this guide helped serve as a valuable resource in launching your nonprofit.

However, when filling out forms for tax-exempt purposes, it's always a good idea to partner with an expert.

Givebutter is proud to partner with dozens of trusted experts to help get your nonprofit off the ground. Through the Givebutter's partner page, you can find industry-leading experts related to compliance, online fundraising, storytelling, and marketing to help guide you through your nonprofit launch.

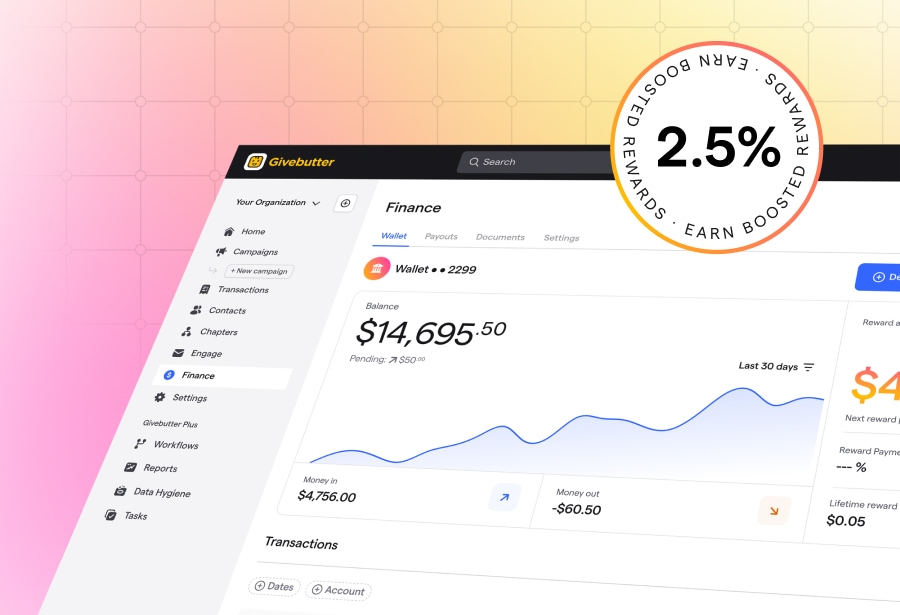

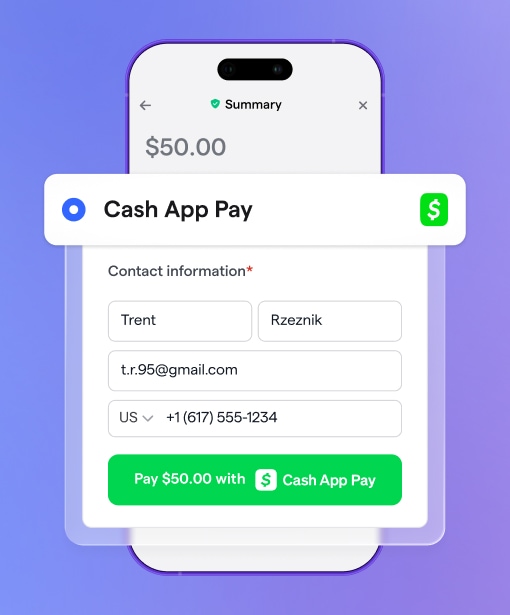

Once you receive your 501(c)(3) status, return to Givebutter to help amplify your message and reach new supporters. Givebutter is the all-in-one fundraising platform helping thousands of nonprofits reach their campaign goals. With everything you need for fundraising, donor management, and supporter engagement under one roof, Givebutter is the perfect fit for scaling grassroots nonprofits—and thanks to the Givebutter Guarantee, its core features are 100% free to use when you enable optional donor tips. Prefer no tips? A flat 3% platform fee applies, plus standard processing you can choose to pass on to donors, make optional, or cover yourself.

Ready to see how Givebutter can get your nonprofit off the ground? Launch your free account to get started.

.svg)

(3)_requirements_4x.webp)

%20(1).png)

.svg)