Table of contents

Table of contents

If you’ve ever considered starting a nonprofit or not-for-profit organization, you’ve probably wondered: Are they the same thing?

Navigating the differences between “nonprofit” and “not-for-profit” can be confusing. Whether you’re filing for tax-exempt status or deciding where to donate, understanding these distinctions is crucial—but many people don’t realize how different the two really are.

In this guide, we’ll break down the key differences between not-for-profit vs. nonprofit organizations, provide definitions, and share clear examples to help you make informed decisions, whether you’re starting an organization or simply supporting one.

What is a nonprofit organization?

A nonprofit organization (NPO) raises money to accomplish an altruistic mission—like feeding families or championing conservation efforts. Nonprofits come in many forms, and the U.S. tax code recognizes more than 30 types of nonprofits (i.e., tax-exempt organizations).

Some of the most well-known include:

- Section 501(c)(3): The most common type, with over 1.4 million in the U.S., including charitable nonprofits, private foundations, trusts, and religious groups

- Section 501(c)(4): The second most common, with over 70,000 organizations like homeowners associations, social welfare organizations, and volunteer fire departments

- Section 501(c)(5): Made up entirely of labor unions

- Section 501(k): Includes childcare organizations

✅ Pros of starting a nonprofit

- Helps create a positive impact

- Builds community engagement

- Can access several funding sources

❌ Cons of starting a nonprofit

- Often relies on donations

- Must follow legal reporting requirements

- Can be an administrative burden

What is a not-for-profit organization?

A not-for-profit (NFPO) is similar to a nonprofit in that it doesn’t aim to turn a profit. However, unlike an NPO, an NFPO doesn't have to exist for the sole purpose of improving society.

While nonprofits are formed for a specific charitable purpose, not-for-profits are often formed to benefit the interests of its members.

✅ Pros of starting a not-for-profit

- Serves the personal interests of a specific group

- Can still create a positive impact

❌ Cons of starting a not-for-profit

- Often relies on volunteers

- Follows different tax requirements

- May not be a separate legal entity

Nonprofit vs. not-for-profit: examples and key differences

While nonprofits and not-for-profits are different, they do have a few things in common. Mainly, neither is designed to generate profits for private individuals.

⭐ Examples of a nonprofit: Habitat for Humanity and Meals on Wheels raise funds to support public-serving missions like housing and food security.

⭐ Example of a not-for-profit: An amateur running club might raise funds for race entry fees, travel, or even events like holiday parties. These costs could be covered by a fundraiser (like hosting a 5k race), but they're typically paid through member dues and fees.

To better understand nonprofits vs. not-for-profits, let’s dig further into the few key differences between the two:

1. Differences in purpose 💪

Both nonprofits and not-for-profit organizations aim to raise funds—but for different purposes.

💛 Nonprofits: These charitable organizations operate with the purpose of providing a public benefit—often through education, social services, or advocacy.

🎉 Not-for-profits: These organizations, on the other hand, can exist for the pure enjoyment of their members or to support a shared interest. A NFPO can be a sports club, social group, trade organization, or college fraternities and sororities.

2. Differences in goals and objectives 🏆

💛 Nonprofits: Nonprofits typically develop a strategic plan each year to set goals for accomplishing their mission. For example, they may set a goal to feed more families, help low-income students apply for college, or lobby for new bills to combat climate change.

🎉 Not-for-profits: Conversely, a not-for-profit will likely set goals that serve their personal interests. For example, a soccer league will aim to raise funds to attend an out-of-state tournament.

3. Differences in staff and organizational hierarchy 👯

💛 Nonprofits: As a startup, a nonprofit might rely on founders and a small group of volunteers to accomplish its mission. However, as the organization scales, it will likely need full-time staff, a formalized board of directors, and an executive team to sustain operations.

🎉 Not-for-profits: Not-for-profits often rely completely on their ability to recruit volunteers and run by committee. There are no paid staff—instead, people simply volunteer their time and energy to support the group’s activities and interests.

4. Differences in nonprofit status 📝

When it comes to filing with the Internal Revenue Service (IRS), both types of organizations follow similar steps to achieve tax-exempt status, such as:

- Filing articles of incorporation

- Establishing bylaws

- Opening a bank account

- Obtaining an EIN (Employer Identification Number)

However, there are important distinctions between nonprofits and not-for-profits under the Internal Revenue Code.

💛 Nonprofits: Most charitable organizations apply for 501(c)(3) status with the IRS. This designation can provide significant financial and operational benefits. According to the experts over at Instant Nonprofit:

Nonprofit corporations are exempt from paying federal, state, local, and certain employment taxes. They are also eligible for tax-deductible charitable donations. This gives added appeal to donors because their donations will be tax-deductible on their end.

🎉 Not-for-profits: Many not-for-profit organizations are classified as 501(c)(7) social clubs, which come with stricter guidelines as to how income can be used (for the benefit of the members only, not the general public). Plus, the funds raised are not tax-deductible.

Nonprofit vs. not-for-profit: How to choose the right one for you

When deciding which type of organization is the best fit for your cause, start by considering your goals and available resources:

- Goals 🎯 Nonprofits exist to make the world a better place. If your mission is charitable, starting a nonprofit is likely the right fit. However, if you’re a sports team or social club looking to fund membership perks, social gatherings, or the like, a not-for-profit may be a better choice.

- Resources 💸 When running a nonprofit, you gain access to tax-deductible donations, grant funding, and the support of board members and full-time staff in addition to volunteers. Not-for-profits don’t get these benefits and typically have to rely solely on the generosity of volunteers to accomplish their goals.

Take your NPO or NFPO to new heights with Givebutter

Whether you're raising funds as an NPO or NFPO, there are powerful tools available to help you grow—without breaking the bank.

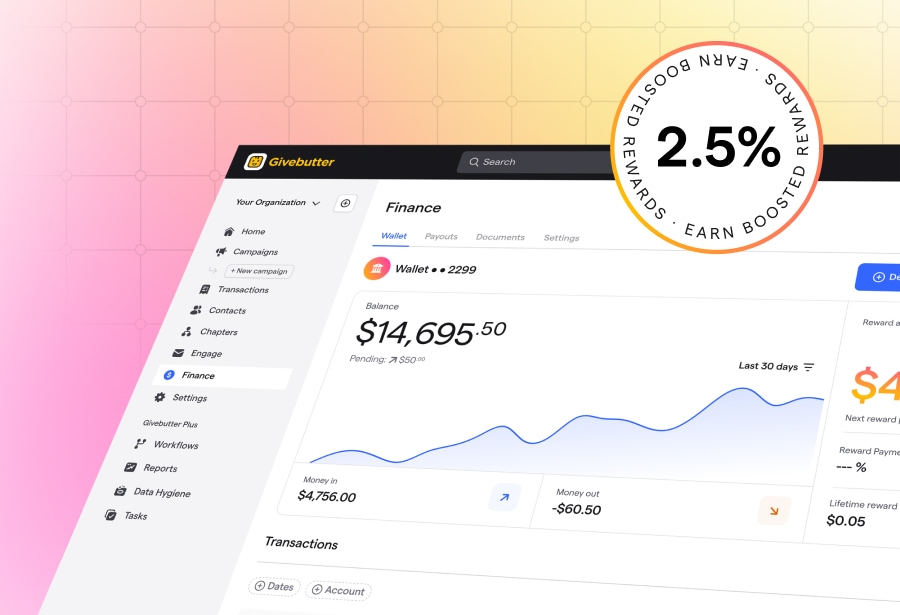

Givebutter is an all-in-one, donor-first fundraising platform that supports a wide range of organizations—including nonprofits, Greek life, social clubs, sports teams, and religious groups.

The best part? Givebutter’s core fundraising features are free! From built-in CRM and outbound marketing tools to modern fundraising features, Givebutter has everything you need to raise funds and engage your supporters.

.png)

Create your first fundraising page in minutes

Ready to raise more for your mission? Launch your free Givebutter account and get started today.

To help bring your ideas to life, we’ve even created this free guide that will walk you through your first fundraiser.

Nonprofit vs. not-for-profit: FAQs

Is not-for-profit the same as nonprofit?

Not exactly. While the two terms are often used interchangeably, there are subtle differences.

Both types of organizations reinvest their earnings into their mission rather than distributing them to owners or shareholders. However, "nonprofit" generally refers to IRS-recognized, tax-exempt organizations, while "not-for-profit" is a broader term that can refer to any organization that doesn't distribute profits to members.

Can a not-for-profit make a profit?

Yes, but those profits must be reinvested into the organization’s mission or activities.

Do not-for-profit employees get paid?

Yes, not-for-profit organizations can have paid employees. They are entitled to reasonable compensation, just like employees in for-profit businesses.

Is there a difference between nonprofit and not-for-profit organizations?

Yes, while both terms are often used interchangeably, "nonprofit" typically refers to organizations that have been granted tax-exempt status by the IRS (like 501(c)(3) organizations). "Not-for-profit" can refer to any organization that doesn’t distribute profits to individuals but may or may not have tax-exempt status.

What qualifies as a not-for-profit organization?

A not-for-profit is an organization that operates for a specific purpose (such as educational, religious, charitable, or social purposes) and does not distribute profits to members or stakeholders. The organizational structure may include generating revenue, but those funds must be reinvested into the organization’s operations and mission.

How to tell if a company is for-profit or nonprofit?

To determine if a company is for-profit or nonprofit, check for the following:

- Tax status: Nonprofits often have 501(c)(3) or similar IRS designation.

- Mission and purpose: Nonprofits are mission-driven, while for-profits are focused on profit generation for owners/shareholders.

- Use of funds: Nonprofits reinvest any surplus revenue into their programs; for-profits distribute profits to owners or shareholders.

What does “not-for-profit” mean?

The not-for-profit definition can be a bit confusing, but essentially, it means that the group operates without the goal of making money. While it can raise money, those funds can only be used to support the organization’s activities.

What’s the difference between for-profit vs. non-profit organizations?

The key distinction between a nonprofit versus not-for-profit organization is how money is used.

A nonprofit organization raises money to serve the public good, like helping those in need or advancing a charitable cause.

For-profit companies exist to make money and can spend their income without restriction. They’re owned by individuals or shareholders and pay taxes just like any for-profit corporation.

.svg)

%20(1).png)

.svg)

(3)_requirements_4x.webp)