Table of contents

Table of contents

⚖️ Disclaimer: The information in this guide is for educational purposes only and is not legal, tax, or financial advice. Nonprofit laws vary by state and situation, so please consult a qualified attorney or tax professional before making decisions for your organization.

For many aspiring changemakers, the idea of starting a nonprofit hits a wall fast. Filing fees, legal paperwork, and IRS forms can all feel overwhelming, especially if you’re starting with little to no money.

Here’s the truth: you can’t start a fully compliant nonprofit with zero dollars—but you can get surprisingly close. With the right approach, smart trade-offs, and a focus on the steps that matter most early on, it’s possible to launch a nonprofit without draining your savings.

In this guide, we’ll walk you step by step through how to start a nonprofit organization with no money. You’ll learn which costs are unavoidable (and which aren’t), how to apply for an EIN and 501(c)(3) tax-exempt status, how to build basic governance, and how to raise your first funds so you can move forward with confidence, even if money is limited.

Key takeaways

- Assess the need and identify your why 💛 Before jumping into launching a nonprofit, determine what specific gap you would address and your reason for getting involved.

- Consider alternatives 🤔 Starting a nonprofit isn’t the only way to make an impact. To save money, consider partnering with an existing charity or working with a fiscal sponsor.

- Create your board and draft bylaws 👥 Assemble a passionate team of people who can help build a long-lasting organization and help you draft governing policies (conflict of interest, dissolution, etc.).

- Register with the state and get an EIN ✅ Register your nonprofit at the state level, and get a free EIN to set up a bank account for your organization.

- Map out a program and revenue plan 🗺️ A strategic fundraising plan will help you decide when and how to fundraise.

- Apply for tax-exempt status and create a business plan 💸 Apply for 501(c)(3) status to potentially qualify for state, federal, and even property tax benefits, and create a business plan that outlines how you’ll operate.

- Start raising funds for free with Givebutter 🧈 With free marketing and engagement tools, donation pages, a powerful CRM, and more, Givebutter helps early-stage founders raise initial funds, organize donor data, and build credibility—for free.

Download your free nonprofit startup checklist

We’ve created a free, step-by-step nonprofit startup checklist to help you move forward with clarity, regardless of your budget.

Download the checklist, then follow along with the guide below. We’ll walk you through each item in detail, so you can make real progress, one box checked at a time.

10 steps to start a nonprofit organization (even on a budget)

Starting a nonprofit with little to no money is possible. The key is to focus on the right steps and avoid costly detours. Follow the 10 steps below to build momentum, stay compliant, and get your organization up and running without breaking the bank.

Step 1. Assess the need 🤔

Across the U.S., 1.9 million nonprofits are making a difference in their communities and competing for the same funding and volunteers. Before you apply for tax-exempt status and launch your marketing strategy, you need to answer one essential question:

Is a new organization needed?

You can determine the answer to this by conducting a simple nonprofit needs assessment. Here’s how to start:

- Create a positioning statement 🎯 Make a list of other organizations with a similar mission. What sets you apart? Use this to draft a positioning statement that explains why your organization is needed.

- Do a SWOT analysis 🔎 SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Use this to identify the primary factors that will distinguish your organization in the nonprofit sector.

It can be a challenge to remain objective when you’re passionate about a new idea. Seek the input of trusted individuals from non-competing organizations when completing your needs assessment to gain different perspectives and more insights to draw from.

Step 2. Identify your “why” 💓

Now that you’ve considered the need, you’re ready to identify your “why.” Ask yourself:

Why am I starting a nonprofit organization? What specific problem do I want to solve?

The answers to these questions will guide you to your mission. Draft a mission statement that explains your organization’s reason for existing and how you’ll serve that purpose. Once you’re clear on this, brainstorm other key qualifiers for your organization, such as your name, values, and vision for the future.

Step 3: Choose your path (nonprofit, fiscal sponsor, or partner) 👯

Before you dive deep into setting up your organization, it’s helpful to understand the different types of nonprofits. Then, consider which route you should take, including whether starting an individual nonprofit is the best and most cost-effective choice.

Here are a few options you might consider:

- Start your own 501(c)(3) nonprofit ⭐ Registering as a nonprofit is the most traditional route. While it offers the most control over your mission and activities, it requires upfront expenses like filing fees and operational costs (staff salaries, equipment costs, etc.).

- Work with a fiscal sponsor 💰 Fiscal sponsorship is an alternative that many smaller organizations choose during the early stages of becoming a nonprofit. In exchange for a percentage of your income, your fiscal sponsor provides your organization with nonprofit tax status and legal compliance resources.

- Partner with an existing charity 🤝 Rather than starting your own nonprofit from scratch, you could consider working with an organization focused on the same mission. You might join their team, expand their programs, or serve on their board.

🤑 Money-saving tip: As a nonprofit startup, you may not have the budget to hire full-time staff, but you still need all the help you can get. What can you do? Recruit volunteers! Get started by sending email newsletters, attending local events, and asking current supporters to spread the word.

Step 4: Build your founding board & governance 🧑💼

Nonprofits aren’t like for-profit businesses. As a charitable entity, a nonprofit can’t be owned by a single person or group. That means you’ll need to establish a board of directors.

For your nonprofit board, you’ll want to assemble a passionate team of people who can pool their knowledge and draw on different skills to build a long-lasting organization.

Your initial board members will develop and execute strategies themselves. This is what’s known as a working board. Later on, it may transition to a governing board, handling the higher-level responsibilities while your staff manages day-to-day tasks.

Step 5. Write and adopt bylaws ✍️

Bylaws are your organization’s primary governing documents. They are a set of internal rules and procedures for how your nonprofit will operate. In times of conflict, confusion, or change, nonprofit bylaws guide your executive director and board of directors on what to do.

Gather your board and draft the first version of your bylaws. Be sure to cover the following areas:

- Mission and legal powers

- Member elections, roles, and compensation

- Fund distribution

- Financial reporting

- Conflicts of interest

- Amendment of bylaws

- Dissolution

Bylaws are typically required for 501(c)(3) organizations, and policies can vary based on your location. Be sure to check with your state's attorney general or Secretary of State.

Be cautious about using bylaw templates from unfamiliar websites, as they may not meet state or IRS requirements. Search for lawyer-reviewed templates or submit your own directly to a lawyer specializing in nonprofit law. You can update bylaws as your organization evolves, but you may need to report changes to the Internal Revenue Service (IRS) and your state.

🤑 Money-saving tip: Many law firms, bar associations, and law school clinics offer free or low‑cost legal assistance to qualifying nonprofits. Check your state or city bar association’s pro bono or “help for nonprofits” programs, and look for nonprofit-focused legal organizations that match community-based nonprofits with volunteer attorneys.

Step 6. Register with your state 🙋

Many nonprofit organizations are required to register at the state level. Even if your state doesn’t require this, there can be benefits to doing so.

Incorporation legitimizes your operation, provides legal protections, and makes it easier to get approved for federal tax-exempt status. The application process is straightforward, but it’s best to start early. It can take weeks or months to get state approval.

Here’s a quick breakdown of the process:

- Choose a name for your organization: Brainstorm potential names, then check their availability by searching your state agency’s business name directory. Make sure you can also secure a matching domain name and social media handles.

- Prepare and file articles of incorporation: Add your organization’s name, address, purpose, expected duration, and board member details. We recommend having a legal consultant review these documents for accuracy and completeness.

- File the articles with your state office and pay fees: The Secretary of State’s office typically processes applications. One cost you can’t avoid is a filing fee of $20 to $100. If you plan to serve in additional states, you may need to register there, as well.

For tips and guidance, reach out to your state’s nonprofit association. You can also outsource this entire process to an online service, such as LegalZoom or BizFilings.

Step 7. Get an Employer Identification Number 💯

An Employer Identification Number (EIN) is like a Social Security number for a charitable organization. You’ll use it to complete tax forms and hire staff later on.

Having an EIN lets you:

- Open a business bank account

- Get a business credit card

- Apply for federal and state tax exemptions

- Apply for small business licenses and permits

- Establish your business credit score

Great news: It’s free to apply for an EIN online!

Step 8: Create a simple program & revenue plan 📊

Most nonprofits rely on a combination of funding sources, including small business loans, grants, fiscal sponsorships, and individual donations. A strategic fundraising plan will help you decide where, when, and how to fundraise.

Creating a nonprofit strategic plan consists of gathering stakeholders, setting clear goals, and defining future objectives that align with your mission and values. It also involves selecting the strategies and tools you’ll use.

🤑 Money-saving tip: It’s unavoidable that you will incur some startup costs. Tap into the community connections and resources you already have to save wherever possible. Partner with local businesses, seek corporate sponsorships, and build relationships with other nonprofits, your elected officials, and municipal agencies.

Step 9. Apply for 501(c)(3) tax-exempt status 📝

501(c)(3) status can exempt your organization from federal income tax, and it may also help you qualify for state and local tax exemptions (including property or sales tax). Contributions to most public charities recognized under section 501(c)(3) are generally tax‑deductible for donors, subject to IRS rules and the donor’s individual tax situation.

To qualify, you’ll need to meet the Section 501 exemption requirements, fill out an IRS form, and pay the associated fees. There are two main ways to apply:

- IRS Form 1023: You’ll have to answer detailed questions about your nonprofit in IRS Form 1023 and include the correct organizing document (such as the articles of incorporation you already wrote). You may need to consult a legal or financial expert for assistance. You’ll also have to pay a filing fee of $600.

- IRS Form 1023-EZ: This is the easy (“EZ”) version of the 1023 created to streamline applications for small nonprofits. Generally, you need gross revenue under $50K and total assets under $250K to qualify. It’s three pages of fairly straightforward questions and checkboxes, and the filing fee is $275.

You’ll need a dedicated bank account to track tax-deductible donations and operational expenses. You’ll also need to keep detailed records of your business activities and finances to maintain your tax-exempt status.

💡 Pro tip: State tax exemption laws vary, so be sure to check your state's compliance guide to determine if you need to apply at the state level or pay an additional registration fee (typically under $50).

Step 10. Put it all together in a nonprofit business plan 📌

A nonprofit business plan provides a snapshot of your organization for prospective donors, banks, and foundations. You’ve already done most of the work for this in the previous steps, so here’s where you put it all together.

Your business plan should include these sections:

- Executive summary: Provide a short overview of your business plan, mission, and vision.

- Goals, programs, and impact: Detail your goals and describe how your programs and services will create a positive impact.

- Industry analysis: Identify who your nonprofit serves, your target donors, and your competitors.

- Marketing strategy: Outline your plan for advertising, promotion, and outreach.

- Operations plan: Cover the short-term and long-term actions that will help you meet your nonprofit’s goals.

- Leadership team: Describe the experience and qualifications of your nonprofit’s leaders.

- Financial plan: Include financial projections and describe how you’ll raise funds, distribute money, handle market changes, and cover costs.

Raise your first funds with Givebutter

Starting a nonprofit with little to no money takes clarity, patience, and smart trade-offs, but it’s absolutely possible. By focusing on the right steps, considering lower-cost alternatives, and keeping early plans simple, you can build a compliant, credible organization without draining your savings.

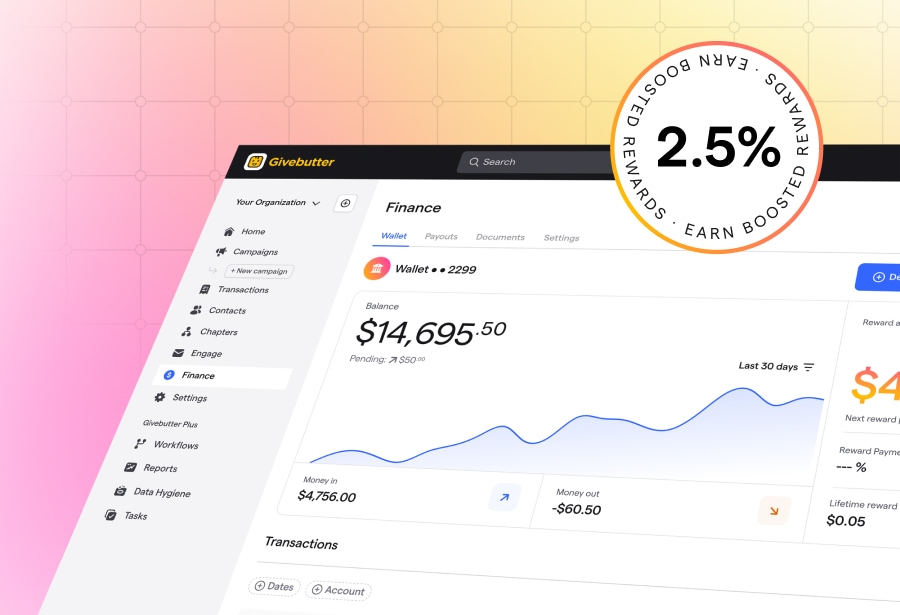

Once you’re ready to start raising your first funds, having the right tools makes all the difference. With Givebutter, you can launch a donation page, peer-to-peer fundraiser, or event to raise the funds you need for filing fees and early expenses, all while tracking donors, sending receipts, and keeping everything in one place.

Thanks to the Givebutter Guarantee, your nonprofit can keep 100% of the funds you raise. When optional donor tips are enabled, you pay $0 in platform fees and $0 in processing fees—and if donors don’t cover the cost, Givebutter will.

Start raising funds for free on Givebutter

Sign up for a free account today to see how Givebutter can help you raise more and pay less on your nonprofit journey.

Explore more free resources for starting a nonprofit

Operating on a tight budget doesn’t stop after filing paperwork. The right strategies and tools can help you raise money, stay organized, and grow your impact without incurring significant expenses.

Explore these free and low-cost resources to support your nonprofit beyond day one:

- Discover more than 70 free or low-cost fundraising ideas 💡

- Challenge yourself to raise $1K in 30 days 🚀

- Compare free online fundraising platforms for nonprofits 🧩

- Discover the best low-cost and free CRM for nonprofits 📊

FAQs about opening a nonprofit organization

Still have questions about starting a nonprofit with little to no money? Here are straightforward answers to some of the most common concerns first-time founders have.

Is it hard to start a nonprofit with no money?

Starting a nonprofit with no money can be challenging, but it’s doable with the right approach. Many founders reduce costs by partnering with a fiscal sponsor, leveraging donated skills and resources (such as office space, legal/accounting help, and marketing), and utilizing free tools like Givebutter to raise funds, connect with donors, and stay organized.

How much does it cost to start a nonprofit?

Most nonprofits pay state incorporation fees and an IRS tax-exemption filing fee. IRS fees are currently $275 for Form 1023-EZ or $600 for Form 1023. State fees vary, so check with your Secretary of State’s office to learn the exact fee amount.

How long does it take to start a nonprofit organization?

In most cases, it takes 3–6 months to start a nonprofit, depending on your state’s processing time and the IRS backlog.

What are some alternatives to starting a nonprofit?

If forming a new nonprofit isn’t the right fit yet, alternatives include working with a fiscal sponsor, partnering with an existing nonprofit, starting as a community project, or launching an informal mutual aid effort.

Can I start a nonprofit by myself?

You can start the process on your own, but most states require more than one director, and best practice is to have at least three independent board members. Always check your state’s nonprofit governance requirements before filing.

Where can I find grants for new nonprofits?

Most grants require 501(c)(3) status or a fiscal sponsor. This guide to grants for nonprofits explains how to find government, corporate, and foundation grants, as well as the eligibility requirements to expect.

.svg)

%20(1).png)

.svg)