Table of contents

Table of contents

One of the best moves you can make when starting a nonprofit is to have tough conversations early on.

The nonprofit landscape can be unpredictable. While it may not happen in the next six months (or even the next year), there will come a time when you are faced with grappling decisions. You may need to call an emergency meeting, remove a board member, vote to terminate an executive director, or debate whether a given action qualifies as a conflict of interest.

None of the above scenarios are enjoyable, but they happen. To best set yourself—and the future of your organization—up for success, you need to agree on how you will handle these situations before they happen.

That's where nonprofit bylaws come in.

Nonprofit bylaws are a legally binding written document that determine how your nonprofit is run. Put simply, they act as the main governing document for your organization. Below, we explain what nonprofit bylaws are, what they should include, and how to write them.

Please note: This post is meant for informational purposes only, and should not be taken as legal advice.

What are nonprofit bylaws, and why do they matter?

Nonprofit bylaws are a governing document establishing how you will operate your organization. Within your bylaws, you will outline responsibilities of your board members, how conflicts are resolved, rules for voting procedures, and what qualifies as a conflict of interest.

Your nonprofit bylaws are important because they create clear, concrete rules on how your charitable organization should be governed. It will help resolve internal disputes, help elect (or even terminate) new board members, and even provide direction on how an annual meeting of the board of directors should be conducted.

Your bylaws help all members of the board of directors understand the expectations, authority levels, and rights of their role.

With that being said, bylaws aren't just a "nice to have" document for a scaling nonprofit—they're actually a legal requirement to file for tax-exempt status. When you file for 501(c)(3) status as a charitable organization, the IRS will ask for you to include a copy of your organization's bylaws as part of your articles of incorporation.

Note: Since your bylaws are a legal document, the IRS offers sample language that should be included within your tax-exemption application. Therefore, when developing your bylaws, it's always a best practice to partner with a barred attorney or CPA who is well-versed in nonprofit tax law.

What should you include in your nonprofit bylaws?

Every nonprofit organization is different, and therefore your bylaws will vary depending on your sector, organization size, state laws, and specific needs. With that being said, there are a few items that should be included within the bylaws of nearly every tax-exempt organization, including:

1. General information 📌

To start off, you'll need to provide a broad overview of your organization. This includes:

- Name and location: Write the name of the corporation, and your physical address.

- Statement of purpose: Describe your charitable purpose of your organization (e.g., literary, scientific, charitable, etc.), as described on your IRS form.

- Mission: Write the mission of your organization. (Note: Do not include your annual goals, as they will change each year and will thereby require an amendment to your bylaws.)

2. Leadership roles, terms, and elections 💁

Even if you're a tight-knit, scrappy operation now, your nonprofit will surely grow over time. As you grow, you will add new board members and officer positions to your org chart.

To help determine the roles and responsibilities of all board members, as well as how these new roles are assigned, be sure to cover the following:

- Voting procedures: How will you elect new board members or executive roles? Be sure to include language for requirements for an election to take place (e.g., 50% of your voting members must be present for an election to take place), what qualifies as a majority vote, what you do in the case of a tie, or how you will call for a special election in the case of a position vacancy.

- Term limits: Determine whether you will have term limits for elected positions. In addition, determine how long each position will be served (e.g., 2-year terms for board members).

- Responsibilities: Prepare every board member by outlining their roles, responsibilities, and annual commitments for their position.

- Indemnification: Indemnification helps protect your board members in areas of risk. It's a statement that limits the personal liability of board members if your organization comes under legal scrutiny.

3. Conflict of interest policy 🙅

Every organization should include a conflict of interest section within their bylaws. To develop this section, review the language provided by the IRS.

According to the Internal Revenue Code, a registered 501(c)(3) organization cannot benefit the interests of one private shareholder—whether it be the vice president of your nonprofit, a member of your nonprofit board, or a recurring donor.

To prevent a conflict of interest from taking place, be sure to include the following:

- Examples of conflict of interest: Provide a list of examples that would qualify as a conflict of interest, and how these would be addressed.

- Disclosing personal interests: Write how staff or board members should inform leadership about a personal conflict of interest. In addition, provide language on how a board member could give up their voting rights on certain matters where they might have a vested interest.

4. Board meeting guidelines 📃

Each year, your board will conduct regular meetings. These annual meetings will discuss fundraising initiatives, annual goals, and strategic planning for the year ahead.

Your bylaws should outline how these meetings should be conducted, including:

- Frequency: How often will you schedule regular meetings? In addition, provide language on how, when, and why a special meeting could be called by an executive committee member.

- Quorum: Your quorum is the minimum number of directors that must be present in order for a meeting to take place.

5. Bylaw amendments ✍

As with any legally binding document, at one point or another your bylaws will have to evolve. To help ease these transitions, include language that shows under what circumstances a bylaw amendment should take place, such as:

- Majority vote: Record what percentage of votes are required in order to pass an amendment.

- Meeting requirements: Determine whether a bylaw amendment vote can take place at a regular board meeting, or if a special meeting is required.

6. Dissolution of the organization 📝

Unfortunately, not all nonprofits last. Therefore, most nonprofit corporations are required—by law—to include a dissolution clause in their bylaws. This statement outlines how assets will be distributed if your organization ceases to exist. This statement should include:

- Distribution of assets: This IRS requires your assets be distributed for a charitable purpose if you dissolve your organization. Therefore, think of what types of organizations you might want to donate any existing assets to.

- Distribution of assets to the government: If you do not distribute assets to a tax-exempt organization, your assets will be distributed to the state, local, or federal government—not a private individual.

Speak to an expert about your nonprofit bylaws

Your nonprofit bylaws are a legally binding document that help determine how your nonprofit operates. Not only will this help resolve conflicts, elect new board members, and schedule board meetings, but it's required under federal law for tax-exempt purposes.

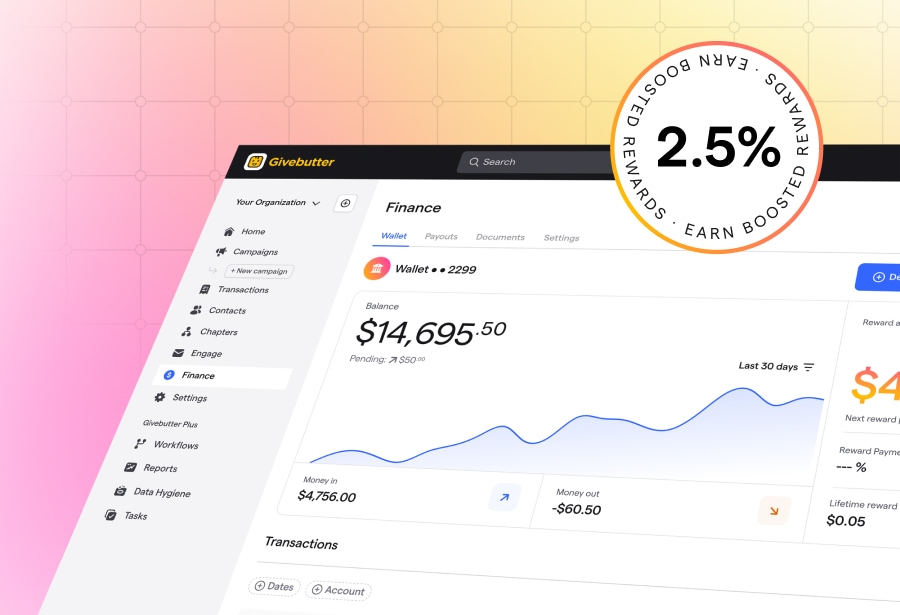

To help draft your bylaws, consider speaking to a Givebutter Expert. Givebutter partners with a number of nonprofit experts in the areas of marketing, communications, data analysis, fundraising events, compliance, and more. Once you draft your bylaws, you'll be ready to file for 501(c)(3) status and launch your organization.

Givebutter is the all-in-one platform that helps scaling nonprofits get off the ground. With your fundraising, donor management, and engagement tools under one roof, you pay $0 when optional donor tips are enabled—backed by the Givebutter Guarantee. Prefer no tips? A flat 3% platform fee applies, plus standard processing fees.

Ready to see how Givebutter can help you reach your fundraising goals? Take a tour of our donor-friendly platform.

.svg)

%20(1).png)

.svg)