Table of contents

Table of contents

⚖️ Disclaimer: The information in this guide is for educational purposes only and is not legal, tax, or financial advice. Nonprofit laws vary by state and situation, so please consult a qualified attorney or tax professional before making decisions for your organization.

Starting a charity often begins with a cause you care about, a community you want to serve, or a change you wish already existed. But once you Google “how to start a charity,” it’s easy to feel stuck between big questions. Do I really need to start a new organization? Can I do this on my own? How much does it cost, and what do I actually need to file?

Many first-time founders quickly learn that starting a charity is less about passion alone and more about understanding the legal steps, timelines, and responsibilities involved. The good news is that with the right guidance, the process is more manageable than it may seem.

This guide walks you through how to start a U.S. public charity, including registration steps, required forms, and other key processes. It also helps you decide whether starting a new charity makes sense for your idea, or if an alternative option could help you get to impact sooner.

Key takeaways

- Start with a clear mission and the right people 💪 Define your charitable purpose, assess community need, and recruit a board that can help guide decisions.

- Know your options before you file 🧭 Starting a new charity isn’t always the fastest path. Alternatives, such as fiscal sponsorship or partnering with an existing nonprofit, may be a better fit.

- Get your legal paperwork in order 📄 Draft bylaws, policies, and organizing documents that guide decision-making and keep your charity compliant.

- Register your charity the right way 🏛️ Incorporate at the state level, obtain an EIN, and apply for federal 501(c)(3) tax-exempt status.

- Plan for costs, timelines, and compliance ⏱️ From filing fees to Form 990s, understand all the costs, timelines, and requirements involved.

- Set up systems that support long-term success 🚀 Choose tools for fundraising, accounting, donor tracking, and compliance early on.

- Put Givebutter to work early 🧈 Accept donations, manage supporters, and fundraise confidently with free, all-in-one tools built for charities.

What is a charity?

Charities exist to help people and communities through activities that are charitable, educational, religious, scientific, or similar in nature. In the U.S., most charities are 501(c)(3) nonprofit organizations, a federal tax classification for groups created to serve the public good.

Charities are one type of nonprofit, but not all nonprofits are charities. For example, social clubs, business leagues, and labor unions may also be nonprofit organizations, yet they serve members or specific interests rather than the general public. These groups often fall under different tax classifications, such as 501(c)(4) or 501(c)(6).

This guide focuses specifically on starting a U.S. public charity. With over 1.8 million charitable organizations nationwide, they’re the most common type of nonprofit people mean when they talk about “starting a charity.”

How to start a charity in 7 steps

Starting a charity is a serious commitment, but it’s not the only way to make an impact. For some ideas, consider partnering with an existing nonprofit or using a fiscal sponsor as a viable option. For others, creating a new public charity makes sense once the legal and organizational pieces are in place.

If you’ve decided to move forward, this guide breaks down how to start a charity organization into clear, manageable steps—covering the registration process, required forms, and what to expect along the way.

Step 1: Define your mission & charitable purpose 🎯

The first step in starting a registered charity is getting clear on your mission. Your mission statement guides every decision you make moving forward. The IRS will also use it to decide whether your organization qualifies as a charitable organization.

Start by answering a few simple questions:

- What specific need does your charity address?

- Who benefits from your work?

- How will your activities create public benefit?

To validate your idea, take time to research what already exists. A nonprofit needs assessment—looking at similar organizations, community gaps, and local demand—can help you decide whether starting a new charity makes sense.

Next, write a short mission statement that clearly explains what you do, why it matters, and how you do it. A strong mission statement is clear and specific. For example:

- “We provide free tutoring to first-generation high school students in [city].”

- “We support families facing medical hardship through emergency grants and advocacy.”

If someone can understand what you do in one sentence, you’re on the right track.

Step 2: Build your board 🧑🤝🧑

A board of directors is a required part of most registered charities, and it plays a critical role in your organization’s long-term success. Your board is responsible for governance, which involves overseeing finances, ensuring legal compliance, and keeping your charity mission-focused.

Most states require at least three board members, and the IRS expects boards to include individuals who can make independent decisions in the best interest of the organization. As you recruit, look for individuals who bring a mix of skills, such as financial management, legal expertise, fundraising experience, or deep ties to your community.

In the early stages, board members may also assist with hands-on tasks, such as fundraising or outreach. Over time, as your charity grows and hires staff, the board typically shifts into a more strategic, oversight-focused role.

💪 Pro tip: Building the right board takes time. Focus on finding individuals who share your mission and are willing to actively support it.

Step 3: Create your bylaws & policies 📄

With your board in place, it’s time to lay out how your charity will operate. Your governing documents help set expectations, guide decision-making, and demonstrate to the IRS and other stakeholders that your organization is well-run.

Work with your board to create the following:

- Bylaws 💼 Outline how your charity is governed, including board roles, voting rules, meeting requirements, and financial management.

- Code of ethics 🔐 Establish shared values and standards that guide behavior, partnerships, and decision-making.

- Conflict of interest policy 🕊 Explain how to disclose and handle potential conflicts to ensure decisions are made in the best interest of the charity.

While not every policy is legally required, having the proper documents in place prevents confusion, supports compliance, and makes later steps, like incorporation and filing Form 1023, much smoother.

Step 4: Incorporate at the state level 🏛️

Before you can apply for 501(c)(3) status, your charity must be legally formed at the state level. Incorporation establishes your organization as a legal entity (and protects board members from personal liability).

In most states, this process involves two main steps:

- Prepare your Articles of Incorporation 📄 Use a nonprofit-specific template to outline your charitable purpose and basic structure. You’ll also include these documents as part of your 501(c)(3) application when you get to that step.

- File with your state 🗂️ Submit your Articles of Incorporation to your Secretary of State (or equivalent office) and pay a filing fee. If you plan to operate or fundraise in multiple states, additional registrations may be required later.

💪 Pro tip: This is also when you’ll officially choose your charity’s name, so make sure it’s available in your state and clearly reflects your mission.

Step 5: Get an EIN 🆔

After incorporating your charity, you’ll need to apply for an Employer Identification Number (EIN). An EIN is a unique federal ID for your organization and is required to open a bank account, file tax forms, and apply for 501(c)(3) status.

The good news? Obtaining an EIN is fast, free, and done entirely online. Once you have your incorporation details handy, you can apply directly through the IRS website and receive your EIN immediately.

💪 Pro tip: Be sure to save your EIN confirmation, as you’ll use this number often.

Step 6: Apply for 501(c)(3) status 📝

Once your charity is incorporated and has an EIN, you can apply for federal tax-exempt status with the IRS. This step officially recognizes your organization as a 501(c)(3) public charity.

501(c)(3) status means your charity generally isn’t required to pay federal income taxes, and donations to your organization may be tax-deductible for supporters—both of which are critical for fundraising and long-term sustainability.

The application process itself is straightforward, but approval timelines vary based on the form you file and the IRS’s current workload, so it’s best to file as soon as you’re ready.

There are two ways to apply:

- Form 1023 (standard application): This is the full application and is required for many nonprofits. It includes detailed questions about your activities and finances, and requires you to submit organizing documents like your Articles of Incorporation. It has a higher filing fee and typically takes longer to review.

- Form 1023-EZ (streamlined application): This simplified option is available to certain nonprofits with less than $50K in annual revenue and less than $250K in assets. An IRS worksheet determines eligibility, and not all organizations qualify, even if they meet the financial thresholds.

No matter which form you use, many founders choose to work with a legal or financial professional to help avoid delays or mistakes.

💪 Pro tip: Keep in mind that this tax exemption is at the federal level. Double-check whether your state or municipality recognizes your tax-exempt nonprofit status. You may also need to pay a state charitable registration fee.

Step 7: Set up operations, fundraising, & compliance 🔧

Receiving your 501(c)(3) status is a big milestone, but it’s really the starting line. Now it’s time to establish simple systems so your charity can operate smoothly, raise money responsibly, and stay compliant over time.

Focus on three essentials:

- Set up basic operations 🏦 Open a business bank account in your charity’s name, set up an accounting system to track income and expenses, and choose nonprofit software to manage donor information. You’ll also want to plan for any physical or digital tools your organization needs to operate effectively day to day.

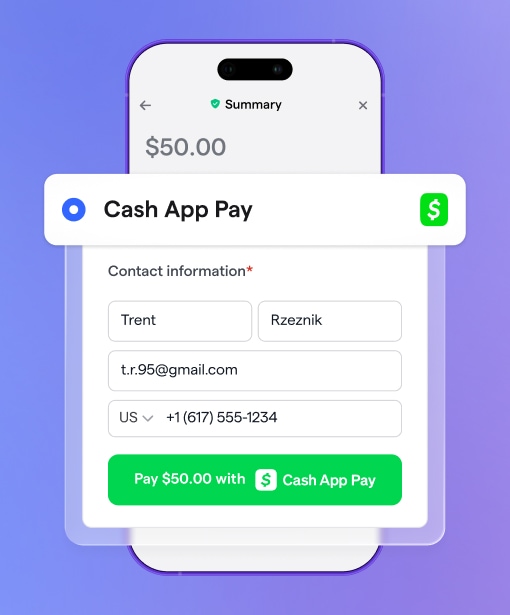

- Build fundraising systems 💳 Choose a fundraising platform that lets supporters donate easily online, processes payments securely, and helps you track and manage donations. Having this in place early makes it much easier to start fundraising and to thank donors properly.

- Stay compliant 📋 Most charities are required to file Form 990 with the IRS annually. You’ll also need to send your donors receipts that include the required tax-deductibility language and stay up to date with any state reporting or registration requirements.

With the right tools and processes, these responsibilities become a natural part of your routine, helping you grow your charity over time.

Start your charity with the best tools possible

Starting a charity is a big decision, but it doesn’t have to be overwhelming. By following the steps in this guide, you’ve learned how to move from an idea to a legally registered U.S. public charity, including what to file, when to file it, and how to set yourself up for long-term success.

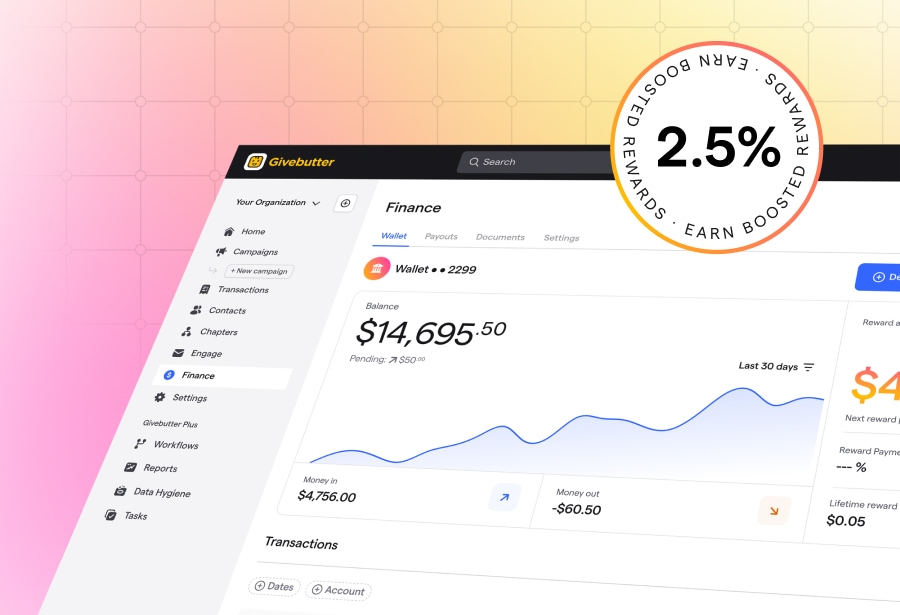

When you’re ready to take the next step, Givebutter makes it easy to put what you’ve learned into action. You can accept donations online, organize supporters in a powerful CRM, send automatic donation receipts, and launch your first fundraiser—all in one place. With free tools designed specifically for new and growing charities, Givebutter helps you focus less on logistics and more on your mission.

Givebutter makes fundraising easy, free, and fun

Create your free account and see how Givebutter makes running a charity simpler than ever.

FAQs about how to create a charity

Starting a charity can bring up many practical questions. Here are clear, straightforward answers to the ones we hear most often.

How much money do you need to start a charity?

Most charities can get started for $500–$2K, depending on your state and how much help you need. The IRS filing fee is currently $600 for Form 1023 or $275 for Form 1023-EZ, and many states charge additional incorporation or charitable registration fees, often between $50 and $500. Many founders also budget early for basics like accounting help, insurance, and simple software or website tools.

How to start a charity with no money?

Apply for grants, use free fundraising tools like Givebutter, and leverage your network (professional connections, volunteers, friends, and family) to ask for donations or expertise.

Consider starting your charity under an existing organization or fiscal sponsor to test your charity idea without the full cost of charity registration.

How to start your own charity?

You can start a charity by defining your mission and completing the required state and federal filings. While you can complete many of the steps on your own, most organizations seeking 501(c)(3) status are required by state law and the IRS to have a board of directors.

How long does it take to start a charity?

Establishing a charity typically takes 3–6 months for planning, incorporation, and registration. IRS approval can take anywhere from a few weeks for simple 1023-EZ filings to several months for full Form 1023 applications, depending on complexity and IRS workload.

How hard is it to start a charity?

Starting a charity takes organization and patience. Drafting documents and filing with the IRS can feel overwhelming, which is why many founders seek professional help for parts of the process.

Fundraising platforms like Givebutter make it easy to accept donations and connect with supporters online, even while you’re working through the legal steps.

How to start a local charity?

Start by understanding a real local need. Talk to community members, leaders, and other nonprofits, then define your mission, build a board, incorporate in your state, and apply for 501(c)(3) status if needed. Many states also require charities to register before fundraising, so check your local rules early.

How to start a sports charity organization?

To qualify as a 501(c)(3), your sports charity must serve a clear public benefit—like youth development, education, or community health—and not primarily benefit private individuals. You’ll likely need sport-specific policies, safety procedures, and appropriate insurance in place.

.svg)

%20(1).png)

.svg)