Table of contents

Table of contents

Donation receipts can be time-consuming and stressful to write. A missing detail or incorrect format could lead to compliance issues or even the loss of a loyal donor.

In this article, we’ll guide you through everything you need to know about writing and sending perfect donation receipts, plus provide a free template to help you get started—so you can focus on fundraising instead of paperwork.

What is a donation receipt?

Also called a gift acknowledgment letter or a donation receipt letter, a donation receipt is (you guessed it) an acknowledgment of receipt for a contribution made to a nonprofit organization with tax-exempt status—whether the donation came through a fundraising page, a live event, an online donation form, or even a website widget.

When should you send a donation receipt?

As a best practice, receipts should be sent within 72 hours, says Donor Relations Expert, Lynne Wester.

In addition, charitable organizations typically send donation receipts at the following times:

- Immediately after a donation is made ⏰ Automation tools like Givebutter’s donation receipt generator make it easier than ever to instantly acknowledge a gift or ticket purchase. Whether you need an in kind donation receipt, or a general one, Givebutter has the tools you need.

- Upon request 💌 Nonprofits that don’t use automatic receipts often send an acknowledgment of a gift when requested by a supporter for a tax deduction. Your nonprofit CRM can streamline searching and filtering contacts and transactions, keeping you organized by marking gifts as acknowledged.

- For year-end donations 🗓️ End-of-year giving reports are commonly used to compile a donor’s yearly gifts for tax purposes.

- After special gift contributions 🎁 In addition to one-time donations and fundraising event ticket purchases, nonprofits also send receipts for recurring donations, matching donations, in-kind gifts, and other special contributions.

What are the IRS rules on donation receipts?

Donation receipt letters are not only essential for donor stewardship and building connections, but they’re also legally required by the IRS. Nonprofits, by law, must acknowledge a gift of $250 or higher with the following details:

✅ The formal name of your nonprofit

✅ The donor’s full name

✅ The date of the donation

✅ A description of non-cash donations (if applicable)

✅ An acknowledgment that donors didn’t receive any goods or services in exchange for the donation

What is the format for a charity donation receipt?

Tax receipts can be sent in many ways—including email, letter, and text. But, it’s important to note that some donation receipt formats are more appropriate than others for a few reasons:

- Email 📩 Email is usually the best option for all charitable donation receipts, as it allows for immediate acknowledgment through automation.

- Letter 💌 Direct mail is ideal for a more formal thank you following an automated email receipt.

- Text 🤳 Text receipts should only be used for small transactions, such as those in a text-to-give campaign.

How to create donation receipts (plus, real examples!)

Follow these five steps to build a donation receipt that checks all the boxes.

Step 1. Automate 🔁

Automating your donation receipts saves time and keeps you organized. Each type of donation receipt can benefit from automation:

- Email 📩 Especially for online donations, email is a practical medium for issuing donation receipts. Many organizations save time by setting up a donation receipt template for automatic donation receipts through a CRM or donor management system.

- Direct mail 📨 Donation receipts can also be sent via snail mail! With Givebutter Mailings, you can create a free donation receipt form to use again and again.

- Text message 🤳 For tech-savvy donors, sending a donation receipt via SMS can be effective. Use texting tools to craft your donation receipt and send immediate, personal thank you messages when donations arrive.

I love that donors can receive a donation receipt instantly. It makes my life so much simpler. I don't have to worry that I missed a donation receipt. — Givebutter review, Angela M.

Step 2. Personalize 💛

As Donor Relations Expert, Lynne Wester, reminds:

Thank the donor, not the gift

While donation receipt letters can feel like just another item on the to-do list, they are a prime opportunity to connect with supporters and make them feel important. That’s where personalization comes in.

Organize supporter data in your CRM using filters, labels, and tags to easily track who you're thanking—and why. With merge fields, you can personalize messages by automatically inserting each supporter's first and last name, donation amount, and even the specific campaign they contributed to.

These personalized touches are key to building and maintaining strong donor relationships.

Step 3. Brand it 🎨

Effective donation receipts include branded elements to remind supporters of who you are.

Plus, a little branding always helps your message stand out from run-of-the-mill spam. Just like creating custom donation forms, specific design elements reinforce your organization’s identity and bolster your connection with supporters.

Design a donation receipt template that reflects your organization by including:

- Your organization’s logo

- Your brand colors and fonts

- Branded illustrations or graphics

Step 4. Show your gratitude 🙏

Donor stewardship involves showing gratitude at every step of the way.

When creating your donation receipt, emphasize the impact of a donor’s gift with specificity. Instead of only including the factual details of a contribution, create a custom thank you message that describes the difference their donation will make.

Provide information about the beneficiaries of the donor’s contribution, how the gift supported essential operating costs, or why their donation is especially impactful during a specific time or season. It’ll make all the difference!

Plus, you can make it pop with embedded video testimonials, photos, and GIFs.

🌟 Check out a sample 501(c)(3) donation receipt letter: For their campaign to provide diverse books at free libraries in their Massachusetts community, Tri-Town Against Racism created this branded, simple (yet powerful) opening message with Givebutter’s free donation receipt template:

Step 5. Inspire 💪

While nonprofit donation receipt templates are all about acknowledging past gifts, they can also be used to inspire future giving. When donors feel genuinely appreciated, they’re more likely to give again. That’s where strategic calls-to-action (CTAs) come in.

To maintain the momentum of giving, great donation receipt templates often include:

- Your nonprofit’s contact information for further communication

- Social media icons and links to stay connected

- QR codes (if sent via snail mail) that link directly to your website, campaign, donation page, or form

Here’s what the remainder of the donation receipt from Tri-Town Against Racism looks like, starting with a record of the message the donor shared on their supporter wall, followed by transaction information, and ending with one-click social buttons for sharing the campaign further:

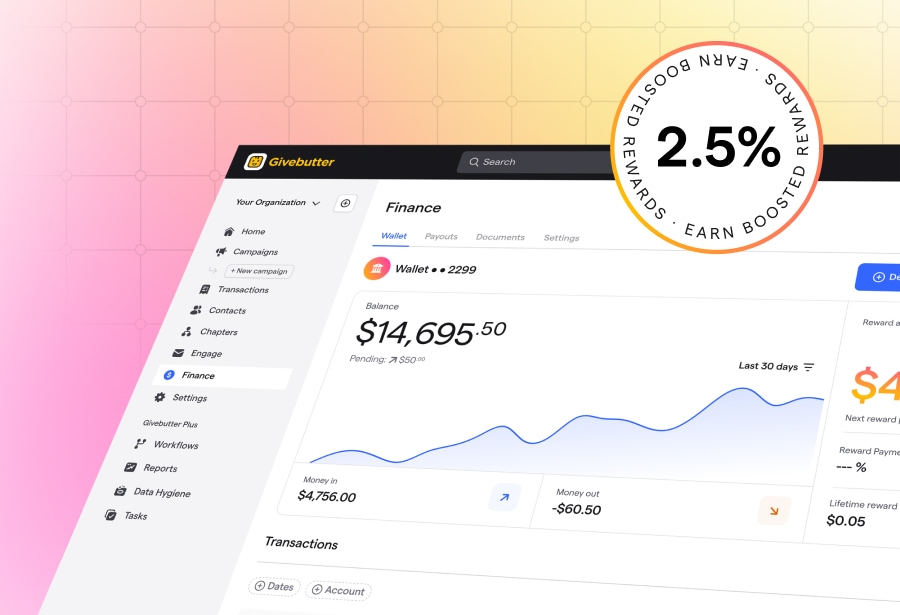

Donation receipt templates—free and built into your all-in-one fundraising solution

Take the stress out of donation receipt letters with Givebutter’s easy-to-use platform, which integrates everything nonprofits need to collect donations, acknowledge supporters, and build long-term relationships.

Every time someone donates through Givebutter, they receive an immediate email confirmation of their donation or ticket purchase with all the tax information they need—donation amount, EIN, campaign details, reference number, and more.

You can even add your branding, logo, and a heartfelt thank you message to customize your donation receipt samples so they reflect your mission and meaningfully express your gratitude.

Set up automatic donation receipts with Givebutter

Sign up for your free Givebutter account, tailor your template for donation receipts to your liking, and see how automation can make your fundraising efforts as smooth as butter.

Receipt for donation template: FAQs

How do I write a receipt for donations?

Creating accurate donor receipts manually can be time-consuming and prone to error. With Givebutter, donation receipts are automatically generated, personalized, and sent to your donors—ensuring compliance and saving you hours of administrative work.

If you need to create one manually, remember to include these key details for IRS compliance:

- Donor's full name

- Donation amount

- Date of the donation

- Nonprofit's EIN (Employer Identification Number)

For non-cash donations, include a description of the item(s) and their estimated value.

What is an example of a donation acknowledgment letter?

A sample donation receipt letter might look like this:

Dear [Donor’s Name],

Thank you for your generous donation of $[amount] to [Nonprofit Name] on [date]. Your support helps us [briefly mention the impact of their donation]. No goods or services were provided in exchange, making your contribution fully tax-deductible.

Thank you for being part of our mission!

Sincerely,

[Your Name]

[Nonprofit Name]

[Contact information]

Pro tip: Customize your receipt with personalized details, such as the specific campaign the donor supported or a heartfelt thank-you message. This small gesture helps build long-term donor relationships.

.svg)

.webp)

%20(1).png)

.svg)