Table of contents

Table of contents

You know your mission inside and out. But managing the financial side of that mission? That’s where many changemakers can get stuck.

Between donor expectations, compliance rules, and stretching every dollar, it’s easy to feel like you’re managing money on a tightrope.

This guide is here to help. Below, you’ll find 10 golden rules that make nonprofit financial management clearer, calmer, and a whole lot more doable—plus a free checklist you can use to stay organized and confident all year long.

Let’s make your financial strategy as strong as your impact. 🚀

Key takeaways

- Create a mission-aligned budget 💛 Build your budget around clear goals, realistic revenue projections, and the actual costs of delivering your programs.

- Forecast your cash flow regularly 💸 Review expected income and expenses monthly so you can anticipate gaps, smooth out timing issues, and avoid last-minute scrambles.

- Build and maintain operating reserves 🏦 Set aside funds to cover unexpected expenses so your nonprofit can stay stable through dips or delays.

- Document strong policies and controls 🔒 Use an accounting manual, internal safeguards, and clear financial roles to keep your organization compliant and protected.

- Streamline your financial workflow with Givebutter 🧈 Track donations, earn APY rewards, manage your CRM, sync with QuickBooks Online, and organize your financial data in one place.

What is nonprofit financial management?

Financial management for nonprofit organizations encompasses a set of practices used to plan, monitor, and steward funds in a transparent, responsible, and ethical manner.

Nonprofit financial management typically involves:

- Building mission-aligned budgets

- Managing revenue streams and cash flow

- Tracking restricted vs. unrestricted funds through fund accounting

- Ensuring compliance with legal and regulatory requirements

- Producing timely, transparent financial reports

Why nonprofit financial management matters

Effective fiscal management does more than track dollars. It helps your organization:

- Remain mission-aligned 💛 Clear budgets and financial goals help you measure progress and keep everyone—from staff to supporters—focused on impact.

- Manage resources wisely 💡 Smart planning ensures you allocate limited funds efficiently and understand the actual costs of running programs.

- Stay compliant 💼 Good financial management helps you meet accounting standards, filing deadlines, and regulatory requirements confidently.

- Build trust 📈 Clear reporting and outcome metrics demonstrate transparency, strengthening donor confidence.

- Plan for the future 🚀 Financial stewardship helps you manage cash flow, build reserves, and make strategic decisions that support long-term sustainability.

Download your free nonprofit financial management checklist

Strategic financial management starts with clarity. Grab your free checklist to turn the 10 golden rules below into a simple, doable action plan your whole team can follow.

The 10 golden rules of nonprofit financial management

Nonprofit financial management is a skill that can be learned. Whether you’re new to the role or leveling up, here’s what strong financial management looks like.

1. Build a mission-aligned budget 💛

Start your nonprofit’s financial plan with clear, mission-aligned goals, then build a budget that gives your team the resources to achieve them. Your budget should outline:

Revenue 📈

- Donations and fundraising

- Grants and sponsorships

- Program fees

- Planned giving initiatives

Expenses 📉

- Programmatic costs (educational materials, transportation)

- Administrative costs (office supplies, subscriptions)

- Overhead expenses (rent, utilities)

- Fundraising costs (event planning, platform fees)

- Personnel/staff costs (salaries, benefits)

Set your budget at the beginning of the fiscal year—but check it regularly. Adjust as priorities, programs, or fundraising realities shift.

2. Stay ahead with proactive cash flow planning 💸

Cash flow can make or break a nonprofit. Look beyond your next event and map out expected income and expenses for the year so you can spot tight months early and plan accordingly.

Diversify your nonprofit funding sources—one-time gifts, recurring donations, grants, DAFs, events, corporate partnerships, and pledges—to avoid relying too heavily on a single source and build a steadier pipeline of support.

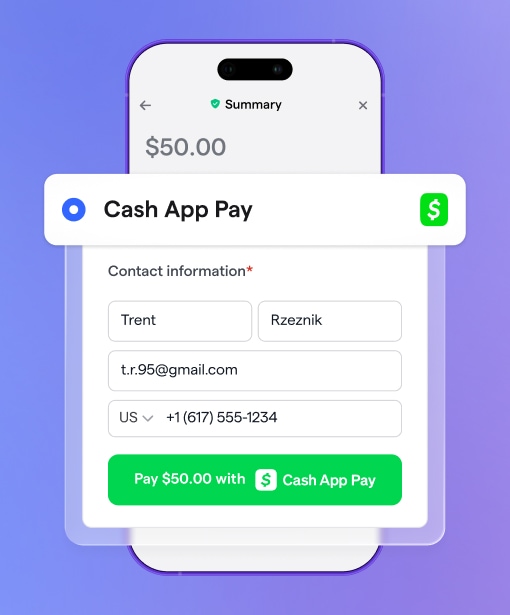

⭐ Pro tip: Choose a fundraising platform like Givebutter that allows you to accept multiple payment methods for donations.

3. Strengthen stability with operating reserves 🏦

Healthy operating reserves ensure programs run smoothly, even when donations slow down, grants get delayed, or unexpected costs arise.

While you may have heard the standard guideline to “save 3–6 months of operating expenses,” that benchmark isn’t one-size-fits-all. Your ideal reserve level depends on your revenue stability, funding restrictions, and overall risk profile.

Consider adopting a board-approved reserve policy that outlines how much to save, when to contribute, and when your organization can use reserves.

⭐ Pro tip: Start small. Even setting aside a percentage of unexpected revenue or your year-end surplus can help you build a healthier cushion.

4. Know your true program costs 📊

It’s not uncommon for changemakers to underestimate the cost of a project, especially when numerous elements are involved. Understanding your actual costs helps you become financially savvy and build a program budget that is less likely to require that vital reserve cash.

List all essential program expenditures, along with your anticipated costs. Ensure that your expected costs align with what you’re actually paying—if not, make the necessary adjustments.

You may discover that you’re paying more than necessary for resources, software, or equipment. Look for alternatives that can save you time and money.

5. Treat “overhead” as essential support 💪

When budgeting, it can be tempting to categorize staff salaries and benefits as overhead, but that outdated framing can actually misrepresent the real cost of your work. Most nonprofit employees wear multiple hats, simultaneously contributing to programs, administration, and fundraising.

Allocate staff time proportionally based on the actual work performed. This approach paints a more accurate picture of the real cost of delivering programs and helps donors understand that people—not just programs—power your mission.

⭐ Pro tip: Use a monthly or quarterly time-allocation process to help staff track the portion of their work that goes toward direct service, fundraising, or operations.

6. Grow a culture of financial stewardship 🌿

When your whole team is aligned on financial management, it’s easier to work together toward a common goal. Invite everyone on staff to get involved in financial planning by:

- Sharing financial reports and projections

- Providing guidance on effective financial management

- Hosting workshops or webinars on nonprofit finance

- Paying for conferences, courses, and learning materials

- Encouraging team members to identify ways to save or raise money

Involving your entire staff increases employee buy-in and motivation. It also helps develop your team members by teaching them valuable new skills.

7. Empower your finance committee 🧭

Your finance committee makes the decisions, but it can only lead with confidence if it has the necessary information. Too much can be overwhelming, and too little can result in delays in obtaining crucial project or program approvals.

Work together to understand what’s needed, then supply your committee members with the right financial data.

Clear, understandable financial reports build trust with stakeholders and empower your finance committee to make informed decisions for your mission.

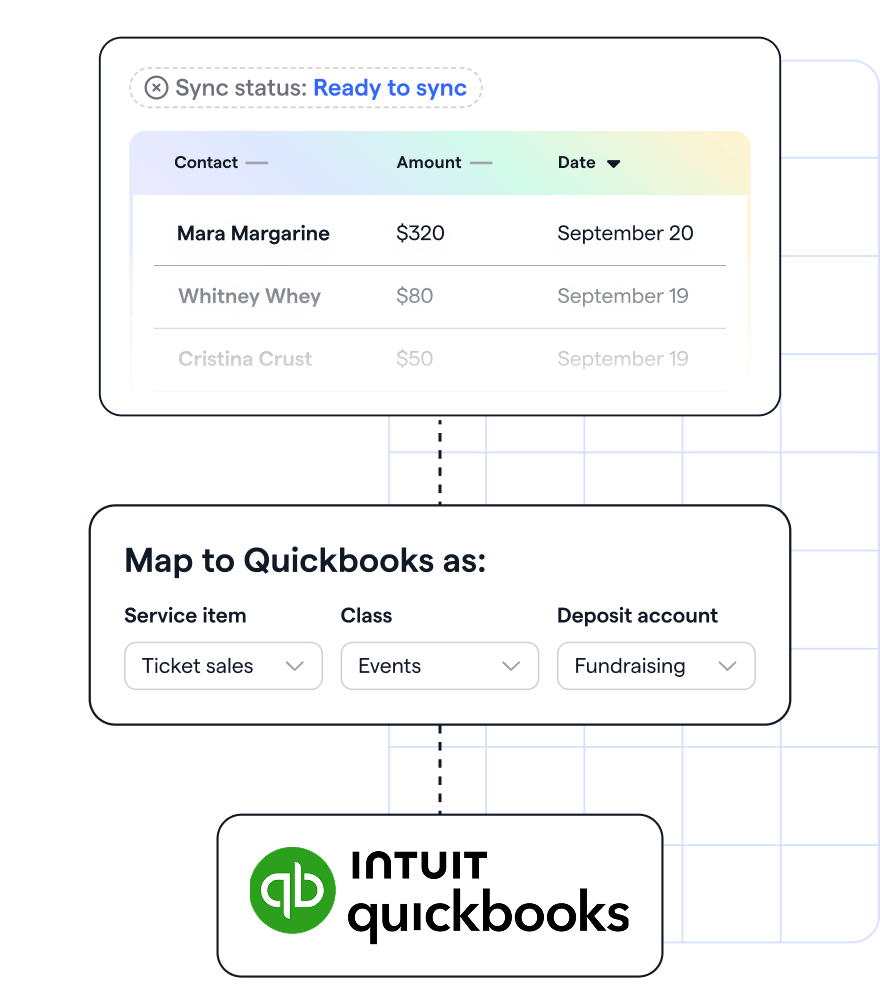

⭐ Tip: Givebutter Plus’ native QuickBooks Online integration makes reporting smooth as butter.

8. Be audit-ready & partner with advisors ✅

Assemble a core group responsible for fiscal strategy and management, and partner with the right advisors and accountants to fill in any knowledge gaps. Make financial health a priority year-round, so you’re ready for anything—especially audit season:

- Prioritize proactive organization and financial record-keeping

- Clearly label and safeguard all financial documents

- Mark key dates for budgeting, reporting, and financial reviews

With your audit-ready financial information, income statements, and statement of financial position, audit time will be a breeze.

⭐ Tip: Don’t think of financial planning for your nonprofit organization as a one-time thing that happens before an audit. Implement regular monitoring to identify issues or areas for improvement as they arise.

9. Keep airtight accounting controls 🔒

Internal controls keep your finances safe, and this, along with a clear accounting manual, gives everyone the confidence and security to stay financially informed.

Develop clear financial policies and procedures that outline the process for handling financial transactions, including approval procedures, record-keeping protocols, and reporting requirements. Improve your internal controls, starting with the basics like:

- Determining who has access to your nonprofit bank account

- Requiring more than one signature on checks

- Securely storing cash donations under lock and key

- Restricting access to financial files to those with appropriate roles

- Clarifying who can and can’t spend money on behalf of the organization

With a robust accounting manual, policies, and internal checks and balances, you’re doing all you can to protect the funds that donors have entrusted to you.

10. Plan for the unexpected 🧠

Financial challenges can come from anywhere at any time, so it’s essential to be proactive when creating budgets and managing spending to help you weather the storm.

Smart cost management involves:

- A clear budget with detailed costs

- Managing cash flow effectively

- Building a cash reserve

- Analyzing costs regularly

- Evaluating new and ongoing vendor relationships for value

- Using finance software for nonprofits

- Investing in nonprofit software that automatically syncs with your accounting software

Consider introducing an annual internal finance and operations audit to review expenses like software, materials, and training.

Start syncing smarter today

The best nonprofit financial management software to try

Managing all your financial compliance and record-keeping manually is time-consuming and leaves you open to human error. Instead, invest in software that helps you stay organized, accurate, and compliant.

Our recommendations for nonprofit management tools and features include:

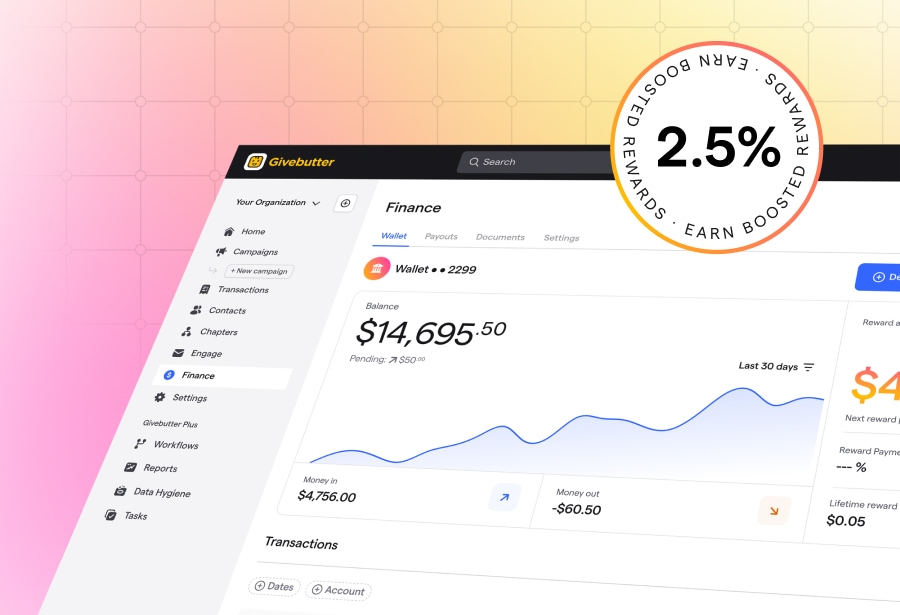

<ul><li>Givebutter Wallet 💸 Your new seamless financial home base, earn <span interest-rate-element="sync">2.5%</span> APY rewards on money raised, send payments, and transfer funds all in one place—only with Givebutter Wallet.</li><li>Givebutter Plus ➕ Streamline processes with automated workflows and enjoy custom reports, expanded data visualizations, and more with Givebutter Plus.</li><li>QuickBooks Online 🤝 Join Givebutter Plus to access our native QuickBooks Online integration, allowing seamless data syncing between the two platforms.</li><li>Donor management 👤 Store all your donor data in one place with a purpose-built nonprofit CRM, complete with donation receipts, activity tracking, and pledge management.</li><li>Transaction tracking ▶️ Monitor every donation and ensure it goes to the right place with our donation management software—designed to track everything from event tickets to offline donations.</li><li>Payment processing 💳 Offer your donors the widest variety of payment methods available and enjoy access to automated payouts with our payment processing for nonprofits.</li></ul>

Other resources for nonprofit financials

Check out the following resources for even more help with your organization’s finances:

- Nonprofit financial support 🤝 The Nonprofit Finance Fund provides consulting and capacity-building services.

- Nonprofit financial training 📚 The National Council of Nonprofits provides free guides and learning resources.

- Nonprofit treasurer report template 🧾 Use our nonprofit treasurer report template to simplify your monthly financial reporting.

- Top nonprofit accounting software 💻 Compare the best nonprofit accounting software to find tools that streamline bookkeeping and compliance.

- Nonprofit audit guide 🔍 Learn everything you need to know to prepare for a successful nonprofit audit.

- Nonprofit accounting checklist 📋 Follow this nonprofit accounting checklist to stay organized and audit-ready.

Take the stress out of nonprofit finance with Givebutter

Strong nonprofit financial management doesn’t just keep the lights on—it fuels your mission, strengthens donor trust, and allows your team to make confident, strategic decisions. With the right tools and processes in place, nonprofit finance can shift from something you manage to something that truly empowers your work.

Givebutter helps you get there. With Givebutter Wallet, you can build financial stability without having to jump between systems. Pair that with flexible payment processing, powerful CRM and donation management tools, robust reporting, and our seamless QuickBooks Online integration through Givebutter Plus, and you have everything you need to manage your finances in one easy, unified platform.

Create your Givebutter account in minutes and see how you can transform your fundraising—and financial future.

FAQs about financial management for nonprofit organizations

Have a question about nonprofit financial management? Here are the most frequently asked questions.

What training should nonprofit board members get on financial management?

Nonprofit board members should receive training that covers fiduciary duties, budget oversight, cash flow awareness, and how to read and interpret financial reports—but it shouldn’t stop there.

Effective financial governance also includes understanding the organization’s overall financial position, reviewing and approving audits, monitoring reserves, learning internal controls and fraud-prevention practices, and knowing how to interpret Form 990 and other regulatory filings.

Are nonprofit financial management certificates or online courses worth it?

Yes! Financial management certificates and online courses can be valuable for anyone responsible for a nonprofit’s finances. The key is choosing reputable programs that match your organization’s size and needs and go beyond basic bookkeeping to cover compliance, audits, strategic planning, internal controls, and long-term sustainability.

Ongoing education—like webinars, conferences, and peer learning—can also help your team stay current on best practices and emerging financial challenges.

Can nonprofits engage in nonprofit investing?

Yes! Many nonprofits can invest in stocks, mutual funds, and other vehicles, but it depends on your board-approved investment policy, donor restrictions, state regulations, and prudent management standards.

Some states and funders place limits on how nonprofits invest or use investment income, so review your bylaws, check relevant guidance (like UPMIFA), and consult a qualified advisor before moving forward.

.svg)

%20(1).png)

.svg)