Table of contents

Table of contents

⚖️ Disclaimer: This guide is for educational purposes only and is not legal, accounting, or tax advice. Every nonprofit is different, so be sure to consult a qualified CPA, attorney, or financial professional to understand the specific requirements for your organization.

The word “audit” might make your shoulders tense up, but take a deep breath—we’ve got you. A nonprofit audit isn’t a punishment; it’s a chance to show the strength of your financial systems, build trust with funders, and level up your internal processes. And with the proper prep, it can feel a whole lot less intimidating.

In this guide, we’ll walk you through exactly what you should know, whether you actually need an audit, which type applies to your organization, how much it might cost, and how to get audit-ready without burning out your team. You’ll also receive a free checklist to help you stay organized and confident throughout the process.

Key takeaways

- Determine whether you actually need an audit 🧭 Review state laws, funder agreements, and federal thresholds to know if an audit, review, or compilation is required.

- Identify which audit type fits your situation 🔎 Understand the differences between financial audits, Single Audits, internal audits, compliance checks, and reviews/compilations.

- Prepare your records ahead of time 📁 Keep your books updated, gather key documents, and organize financial data so auditors can work efficiently.

- Strengthen your internal controls 🎯 Review permissions, approvals, and safeguards to ensure your financial processes are secure and audit-ready.

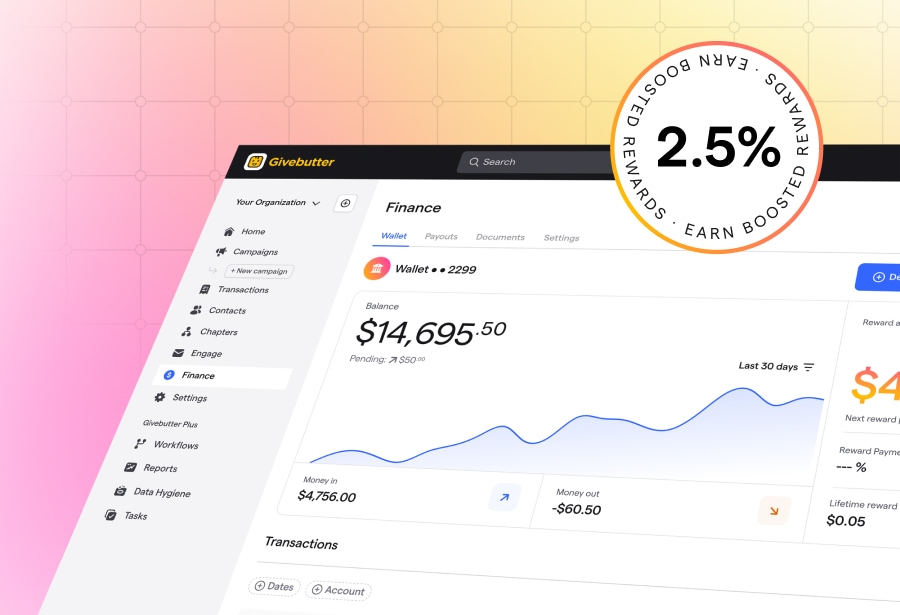

- Streamline audit prep with Givebutter 🧈 Use built-in tools like donation management, Wallet, and QuickBooks Online integrations to keep your financial data clean, organized, and audit-ready year-round.

What is a nonprofit audit?

A nonprofit audit is an independent review of your organization’s financial statements, records, and internal processes to confirm everything is accurate and compliant. Most nonprofits rely on a certified public accountant (CPA) or audit firm to conduct this review.

During the audit, the CPA reviews your financial data, examines key policies and procedures, and evaluates your internal controls. At the end, they issue an opinion that helps funders, boards, and other stakeholders understand the overall health and reliability of your financial reporting.

4 types of audits for nonprofits (and when you’ll see them)

Nonprofits encounter various kinds of financial reviews, but only some of them are considered true audits. Here’s a clear breakdown to help you understand what’s what—and when each one shows up in real life.

1. Financial statement audit 🧮

⭐ When you’ll see this: A funder, your state, or your bylaws require independently audited financial statements.

A financial statement audit is the standard nonprofit audit. An independent CPA firm reviews your financial statements, tests transactions, evaluates internal controls, and issues an audit opinion under GAAP.

This is the audit most people mean when they say “nonprofit audit.”

2. Single Audit (federal compliance) 💰

⭐ When you’ll see this: Your nonprofit spends enough federal funds in a year to trigger federal audit requirements.

A Single Audit is a specialized version of a financial audit required for nonprofits that expend federal funds above the federal threshold.

It includes everything in a financial statement audit, plus more thorough testing to ensure compliance with federal grant rules. Small nonprofits usually won’t deal with this unless they receive large federal grants.

3. Internal audit 📋

⭐ When you’ll see this: You want a financial “health check” to prepare for an external audit or strengthen your internal controls.

Your staff, finance committee, or board conducts internal audits. They review your processes, internal controls, and financial records to ensure everything is running smoothly.

While not a replacement for an independent audit, they’re a smart way to catch issues early and stay organized before the real audit begins.

4. Compliance audit 🔬

⭐ When you’ll see this: You need to confirm that you’re following specific laws, grant requirements, or internal policies.

A compliance audit checks whether your nonprofit is doing what the rules say, whether those rules come from a grant agreement, state regulations, or your own bylaws.

Some nonprofits conduct these reviews as standalone exercises, while others incorporate compliance testing as part of their annual audit.

Low-cost audit alternatives for nonprofits

Some funders don’t need a full audit and will accept one of these lower-cost options instead. These reviews can strengthen your systems and help you prepare for growth, but they aren’t financial audits under GAAP—so they don’t replace an independent audit if one is required.

Review engagement 📄

⭐ When you’ll see this: A funder wants limited assurance but doesn’t require the time or cost of an audit.

A CPA performs a high-level review of your financial statements to confirm they look reasonable. They don’t test transactions or dig into controls, which makes this faster and more affordable than a full audit.

Compilation report 🧾

⭐ When you’ll see this: You need professionally prepared financial statements, but no assurance.

A CPA organizes your financial information into GAAP-formatted statements without providing any level of assurance. This is the simplest (and least expensive) option.

Other financial examinations nonprofits may encounter

These aren’t audit types, but they’re helpful to be aware of.

IRS audit 🏢

⭐ When you’ll see this: The IRS flags your Form 990 or identifies inconsistencies.

IRS audits are rare, but they can happen. They focus on federal compliance and tax-exempt activities—not your GAAP financial statements.

If selected, the IRS will request supporting documents, such as ledgers, receipts, or contracts.

Being audited by the IRS can be time-consuming and put extra pressure on your team, so it’s always best to file all your forms accurately and on time.

Operations audit 🧘

⭐ When you’ll see this: You want to understand how your internal processes are working so you can improve them.

This is an internal review of how your organization functions—from HR to IT to program workflows. It’s not a financial audit, but it can reveal helpful ways to work more efficiently, especially before switching systems or software.

Does my nonprofit actually need an audit?

Whether your nonprofit needs an audit depends on state law, funder requirements, federal grant thresholds, or your own bylaws. It’s essential to check the nonprofit audit requirements of the state where you operate.

Some states require audits once you pass a certain annual revenue or contribution threshold. But in many cases, a full audit isn’t necessary. Most federal grants require an audit, but other nonprofit funding sources, like private foundations and smaller grantmakers, may accept a financial review or compilation instead.

For context, many small nonprofits (especially those with annual revenue under $250K) rarely encounter audit requirements. Most states don’t require audits at that level, and smaller funders typically ask only for a review or a simple financial statement.

💪 Pro tip: Even when an audit isn’t legally required, many nonprofits conduct one annually to enhance transparency, build confidence among funders, and prepare for future growth.

Download your free nonprofit audit checklist

This free checklist guides you through every step of the pre-audit process, helping you stay organized, avoid last-minute stress, and feel confident heading into audit season.

Inside, you’ll find easy, step-by-step tasks you can check off as you prepare, plus helpful reminders to keep your team on track year-round.

How to get audit-ready in 6 easy steps

Whether you're preparing for an independent audit or running an internal checkup, a little organization now can save a lot of stress later. Here’s how to get audit-ready in six simple steps.

1. Keep your books up to date 📘

Accurate, organized books are the foundation of any smooth audit—and healthy financial management overall. Use nonprofit accounting software you trust, review your statements regularly, and fix discrepancies when they appear. Clean data means fewer surprises for your auditors and fewer headaches for your team.

If you use Givebutter Plus, our QuickBooks Online integration automatically syncs every donation, refund, and fee—no manual entry or spreadsheet juggling required.

Make audits easy with a QuickBooks Online integration

2. Gather and organize your documents 📁

Your auditors will need access to policies, procedures, statements, and supporting documents. The more organized you are, the faster they can work.

Create a clear folder structure (digital or physical), standardize file names, and encourage your team to keep it tidy year-round. Future you will be grateful.

3. Track restricted vs. unrestricted funds 🎯

Restricted dollars come with special responsibilities, and your auditors will want to ensure that those funds were handled exactly as the donors intended. To stay compliant:

- Label and track restrictions clearly

- Note when funds were released and how they were used

- Save any supporting documents that show impact

Tools like Givebutter’s donation management software keep everything neatly organized (and export-ready), so you always have a clear record of where every dollar went.

4. Strengthen internal controls 🔐

Internal controls are your nonprofit’s financial guardrails. They protect your team, your donors, and your mission. Audit prep is a great time to review:

- Who can approve expenses

- Who has access to financial accounts

- Whether dual approvals are required

- How well your documentation trail is maintained

Look for gaps or bottlenecks and tighten anything that feels unclear or outdated. Strong internal controls reduce risk, prevent errors, and facilitate a smooth audit process.

5. Double-check grant and funder reports 📝

Every grant has its own rules, and your auditors will want to see that you followed them. Take a moment to revisit your grant agreements, highlight the reporting requirements, and double-check that everything you’ve submitted matches your books.

6. Review and check in with leadership 💛

Before your audit is due, conduct a thorough review of all the information above and report back to the leadership team with your findings.

If your pre-audit checks have identified any issues, it’s essential to inform your leadership team or board members in advance. You may have time to introduce a fix or improve processes.

Enjoy efficient, audit-ready operations with Givebutter

Audits always feel more manageable when your financial information is clear, organized, and easily accessible. Now that you know what goes into audit prep, the next step is making sure your day-to-day systems set you up for success—not stress.

Givebutter is designed to help changemakers spend less time digging through data and more time doing the work that matters. By keeping donations, payouts, and transaction details in one place, Givebutter helps you maintain tidy records year-round.

And because our QuickBooks Online integration syncs your activity automatically, it reduces the manual work that often slows teams down: fewer spreadsheets, fewer surprises, and a smoother audit season.

⭐ Create your free Givebutter account today and stay audit-ready all year long.

FAQs about nonprofit financial audits

How do I choose the right nonprofit audit firm?

Look for a CPA firm that regularly audits nonprofit organizations of your size and understands your funding mix. Ask about pricing upfront, make sure there are no conflicts of interest, and check references from peer organizations or your state association of nonprofits. Most nonprofit audit services can be conducted remotely, but choose a team that suits your preferred work style.

Is a 501(c)(3) required to have an audit?

No. There’s no federal law requiring every 501(c)(3) organization to undergo a financial audit. Audits are typically required only if state law, a funder or grant agreement, or your organization’s bylaws mandate one. The only federal exception is the Single Audit, which applies when a nonprofit spends a large amount of federal funds in a year.

When does a nonprofit need an audit vs. a review?

A nonprofit typically needs an audit when a funder, state law, or your bylaws require a complete, independent examination of your financial statements and internal controls. An audit provides the highest level of assurance.

A review is a lighter, lower-cost option. A CPA performs analytical procedures and inquiries—but no detailed testing—to provide limited assurance that your financial statements appear accurate. Many smaller grants accept a review instead of a full audit.

How much does an audit cost for a small nonprofit?

Audit costs vary widely, but most small nonprofits can expect to pay $5K–$20K for an annual financial audit. Fees increase with organizational size, number of funding sources, grant complexity, and reporting requirements. Very small nonprofits may see slightly lower rates, while complex or first-time audits may cost more.

Most small nonprofits (especially those under $250K in annual revenue) rarely face audit requirements. Many states only require audits once revenue or contributions exceed higher thresholds, and smaller funders typically request only reviews or basic financial statements.

Are nonprofit audits public record?

Not by default. A nonprofit’s IRS Form 990 is always public, but its audit report is not automatically made public. Some nonprofits choose to publish their audits to promote transparency, but they are not required to do so unless a funder or state agency requests it.

How long does an audit take?

Most nonprofit audits take 2–4 weeks once the audit fieldwork begins, plus several weeks of preparation beforehand. First-time audits or audits of more complex organizations may require additional time to gather documents and complete testing.

.svg)

%20(1).png)

.svg)